If you don’t know what a blind-spot bias is then you’ll be pleased to know you’re about to level up your trading game for free. In fact, you’ll change the way you see the world, and the vast majority of the people in it, if you step back and really think about the true repercussions of the information you’re about to receive.

We like to think of ourselves as reasonable, rational, logical, bi-pedal mammals but the truth is we’re totally out of control most of the time.

Blind spot bias is, in a nutshell, being unaware of your own ability to form biases and how they ultimately affect your thinking.

In other words, if you don’t realize that your built in mental operating system has plenty of glitches and bugs you’re not going to even realize that your thoughts are tainted or – perhaps even more scary – they are not even your own.

These thoughts, or patterns of analysis, can cost you big time in the world of trading and finance.

Here Are 7 of the Key Biases You Need to Actively Filter Out

1 - Clustering Illusion

Let’s start with a very broad one that is an umbrella for many other biases.

We all want the world to make sense, there’s comfort in being able to make predictions. So it’s only natural that we stretch facts further than we should in order to feel like we know why things are happening.

The clustering illusion pops up when you begin to see patterns that aren’t actually there. Usually this is due to either a lack of data or reliance on invalid data.

In the trading world this becomes an obvious problem:

- You might make broad assumptions based on a handful of trade results.

- You could look at ancient fractal patterns and allow that to sway your thoughts in the here and now (Twitter is full of this madness).

- etc.

It’s common in Crypto trading to hear phrases like ‘weekend pumps, monday dumps’. This is an example of a clustering illusion bias in the sense that people will assume weekend price action always results in a nasty sell off simply because they’ve seen it enough times before.

In reality though it’s obviously not happening all the time and there are a huge number of variables in play that dictate if a weekend pump will end with a crash.

Learn to identify random outcomes vs actual patterns or you might as well join the crypto astrology cult (yes that’s a real thing).

2 - Outcome Bias

This one is extremely dangerous for budding traders as it prevents learning and growth.

Outcome bias occurs when you lean too much on the final result of a decision (to make a trade for example) rather than how you actually arrived at that decision step by step.

For amateurs, trading is all about outcomes. Win or Loss.

On the other hand, long term profitable pro traders focus their attention on their decision making processes.

Zero f**ks should be given about a loss, or even a string of losses, because trading is about following a plan that you adapt to changing market conditions.

When you win, thank your plan, not your god-like guru powers. You see it on social media all the time. Some punk makes a decent trade and then proceeds to act like some sort of trading god.

Putting all attention on the outcome and sharing nothing about how or why that trade was made in the first place.

This ties in with attribution bias where we’re more likely to take credit for good outcomes but blame everything and everyone else when we get a bad outcome.

This means you’re not going to analyze your successes and failures properly because you’re defining things by the outcome rather than the process PLUS you’re inherently adverse to even looking inwards when things do go wrong.

Your ego really is your worst enemy.

Melt your childish, egotistical defense mechanisms down as quickly as you can.

3 - Recency Bias

Recency bias occurs when we choose to put more weight on newer information than on older, but still relevant data. In other words, we like to assume that what’s happening now is far more important than what happened in a previous cycle.

This ties in with the previously discussed outcome bias to make current events and outcomes incredibly attractive think about vs what we may have already learned from previous experience.

This bias is extremely common in trading and it has a habit of instantly ‘triggering’ people:

- You get 3 losses in row – “trading is a scam, f*** this!”

- You get 5 early closed trades – ”It’s all close early, f*** this!”

- The last 3 signals move out of entry too quickly for you – “Every trade does that, f*** this!”

This is a real problem in trading because we’re all trying to stick to a long term plan, meanwhile part of our brain is trying to entirely sabotage the operation with exaggeration combined with childish projections (attribution bias).

Reviewing data helps to alleviate this problem along with always reminding yourself to think long term.

Learn to spend your energy refining your plan based on new data, rather than throwing your plan in the trash everytime you win or lose.

4 - Information Bias

More data, more news, more influencers, more charts. Your brain always thinks more = more.

It’s not, you probably just don’t know what you’re looking for.

In that situation your brain defaults back to the ‘clustering illusion’ and tries to find a pattern that isn’t there even if that means just piling up more and more data until you find what you want.

One of our trade teams favourite expressions is “Keep It Simple Stupid” (KISS) and they’re regularly making insanely accurate market predictions. Often our charts have 1 or 2 lines that matter. 1 or 2 indicators. You don’t need more if you know what you’re looking for.

Ignore the crazy folk on social media with their over the top show-boating analysis. Learn to accept that less = more.

Master a few indicators and setups and then milk them.

5 - Disposition Bias

Disposition bias is a serial killer in the trading community (and he is living inside your head right now), so it’s absolutely crucial to understand or you will end up being the next victim.

I bet you’ve already experienced both of these things:

- You made an epic entry, a fantastic trade by all counts, but as you see the profits rising you can’t help but get anxious and feel the urge to close that winner down too soon.

- A trade starts to go bad. But instead of exiting you continue to hold a loser in the hopes that things suddenly, and irrationally, turn around. Worse…you start adding to your trade to try and ‘rescue’ it.

Your brain craves the dopamine rush of a win and dreads the feelings that come with sucking up a loss. This creates an extremely unhealthy trading environment that frequently leads to total decimation of your trading balance.

This is why we use the Trade Guardian automation to get out of trades early. It’s why we create full trade plans with defined exit points, win or lose.

Studies have shown that the more sophisticated a trader or investor is, the less likely they are to fall victim to disposition bias.

Treat each trade in isolation and don’t let your previous losses affect your ability to make profits. Basically learn to take a loss like a champ and leave your winners alone.

Be a sophisticated bag of meat and bones.

6 - Herding Bias

Baaaaah! Your inner sheep is another villain looking to throw you off a cliff at the first opportunity it gets.

You’ve most likely come across the terms ‘fear, uncertainty and doubt’ (FUD) and ‘fear of missing out’ (FOMO). These are classic examples of big money using your biases against you and are direct reasons why retail loses so much money.

Think about it, Elon Musk goes on Saturday night live to promote DOGE coin to moms and pops, meanwhile big money are furiously dumping their bags on the FOMOing public and the price drops -30%.

It’s all about creating liquidity and herding biases are used over and over again to create this cycle.

It takes courage but you’ll almost always want to stick to your own point of view and analysis. Large, mainstream channels – including influencers with huge follower numbers – are almost always bought and paid for. They are not your friends, they’re just cunningly disguised as ‘random individuals’ who made it.

“Buy the blood”, “Sell the euphoria”.

These mantras are there to protect you from yourself.

Know when you’re riding a technical trading trend vs a media fuelled hype trend.

7 - Anchoring bias

Let’s finish this list with a funny one. You’re a stubborn git.

Whatever you learn about a project or service or person (etc) first is what you hang on to. It subconsciously forms your perception of that thing and works as your comparison for future information.

This can affect your trading in a very special way in the modern world due to social media and the herding bias we just mentioned. If you wake up and open the news, Twitter or Reddit and browse around, you’ve just preprogrammed yourself to think a certain way before you’ve even opened up your charts.

Why do you think we always point out the media collusion and copy paste headlines such as “crypto winter”, “crypto crash” when we’re actually approaching bottoms? At tops we get the opposite copy paste nonsense all over the place!

What you see first will impact how you go about your day, for example:

Negative headlines and chatter? Better check the charts and look for short trades…

The anchoring effect also means that you begin to ignore fresh data coming in that contradicts your original view. You’ll skip over evidence that suggests we’re clearly on a support and should be looking for long trades.

It’s entirely ridiculous that we can become totally illogical and simple minded so easily, and yet big money uses this against the masses all the time.

Be open minded, be fluid in your opinions, challenge yourself at all times.

How to Trade Without Bias and Keep a Cool Head

If you’ve been paying attention so far then you’ll have noticed a few common themes:

- You’re out of control and make untrustworthy decisions

- Your fellow humans are just as bad, probably 5x worse because they didn’t read this

- Big money is actively playing on those biases and succeeding

Let’s get you sophisticated.

We can do that by removing you from certain parts of the trading equation, offering trustworthy analysis and by making use of undisputable data.

Trading Automations

Our first mission is to make sure you never suffer from the serial killer, disposition bias, and blow up your trading account.

You still have to decide when to trade and what to trade, but by using the copy-trade functions you’re removing the risk of disposition bias entirely.

Each signal includes an entry, stop loss, multiple take profits and defined reasons why you might leave the trade early (automated via Trade Guardian). There is absolutely no way that you’ll ever hold onto a loser or stop your winners from running.

Train yourself to always make your own trades in the same fashion. Fully planned out. You can make use of the manual trading terminal to create your own fully packaged trade plans without waiting for signals.

Stop hitting market buy and making the rest up as you go along!

Crypto Market Analysis and Tools

Instead of tuning into the news or social media, start by looking at what our trading team has to say.

Our analysis is straightforward and has been amazingly accurate throughout bull and bear cycles. Sometimes you’ll need to be patient as markets take time to move around and make strange patterns as they make their way from point A to point B but we’re almost always right eventually.

We told you Bitcoin and Alts would dump like crazy all the way back in April. You just need to pay attention and accept the analysis even if you don’t like what we have to say 🙂

This way you’ll avoid herding bias and anchoring onto the wrong information. We’re not saying you shouldn’t do your own research, just make sure you really understand how mass media and social media function before you start gobbling up the headlines and promoted tweets.

Another source of unspoiled information is the Price Action Scanner. No headlines, no opinions, just technical trends, trends, trends. If you want to know which coins have some momentum and are worth investigating, all you need to do is check the scanner and look for green squares in the timeframe you’re interested in.

Learn to take action with our analysis in mind, even if that means not trading for a while!

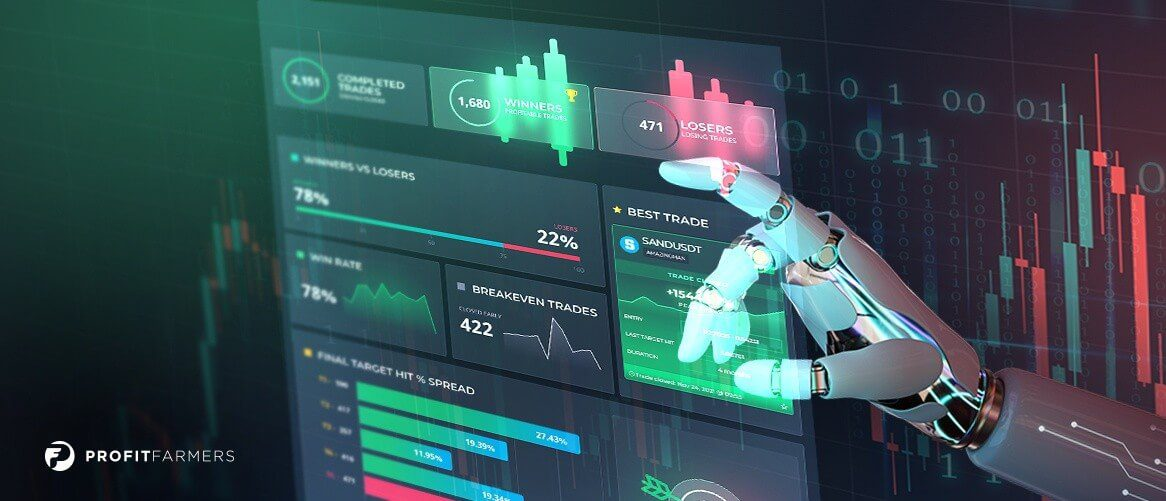

Signal Results and Other Data

Your outcome and recency biases (speaking of everyone that’s ever used the ProfitFarmers platform) have led to a few common misunderstandings coming up about the signals, especially from newer members, and it’s almost exclusively when the markets have been more stressful to trade.

Here are the top 3:

1 – “Early Closed Trades are all losers”

2 – “Winning signals never come deep into the entry zone”

3 – ”Signals never show up when I’m awake”

Instead of repeatedly answering these kinds of emotionally loaded statements we’ve been steadily pushing out data over the years to show you everything you need to know.

The net peak gains calculator widget was created to show the actual impact of early closed trades and provide some insights into how AWESOME they are compared to taking an unnecessary full loss. It also goes to show that lots of trades that close early do so in profit!

Biases make you get hung up on the bad things that happened RIGHT NOW and shake you off your plan and away from reality.

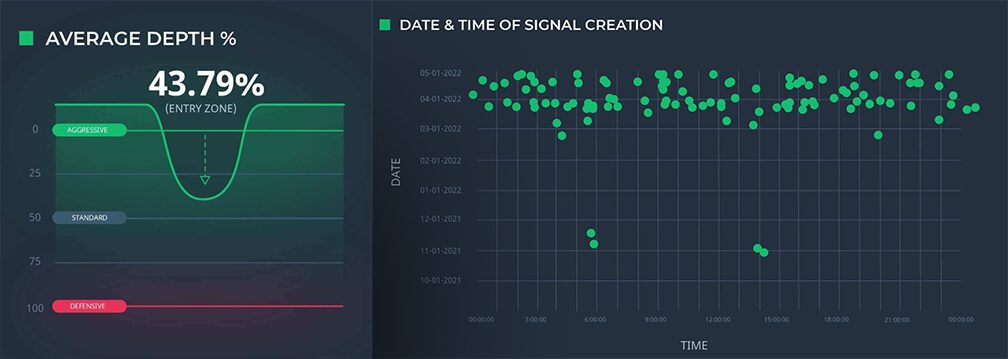

We added a read out of the average entry depth and the date/time of signal creation to our monthly signal results breakdowns to take care of statements 2 and 3 above.

You can find lots of other data in our monthly breakdowns that shed light on reality and keep new traders cool headed and focussed on finding a solid trading plan suitable to the current trading conditions.

Combine everything (automations, tools, analysis and data) to remove your biases and find the inner peace needed to create a trade plan, stick to it and adapt with the ever changing world around us.