Kyne Myers

$10,000 to $35,000 in 9 Months: Kyne’s Trade Journal Shows Exactly How You Can Make Trading Your Profitable Side Hustle

Turning a bad situation into a good outcome is truly one of the greatest magic tricks anyone can learn in life, and that’s exactly why Kyne’s story is so inspirational.

Kyne Myer’s, an Australian electrical engineer, received a serious spinal injury whilst on a job, that left him unable to work and unable to walk without support. He knew he needed to develop a side hustle in case he could never work again.

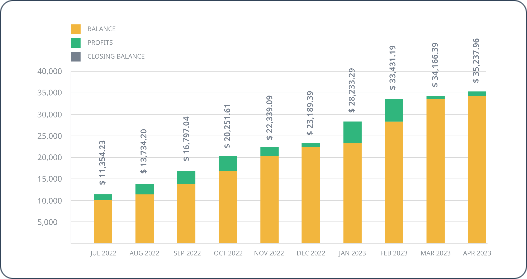

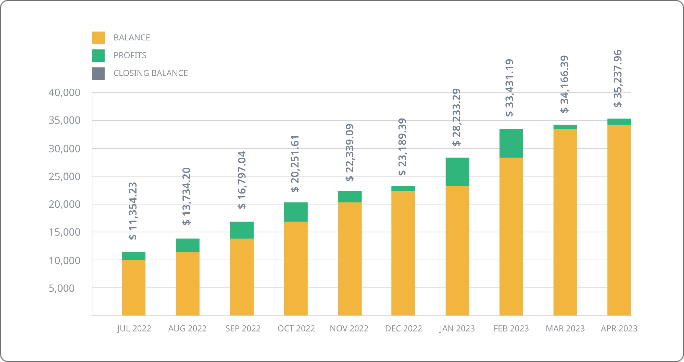

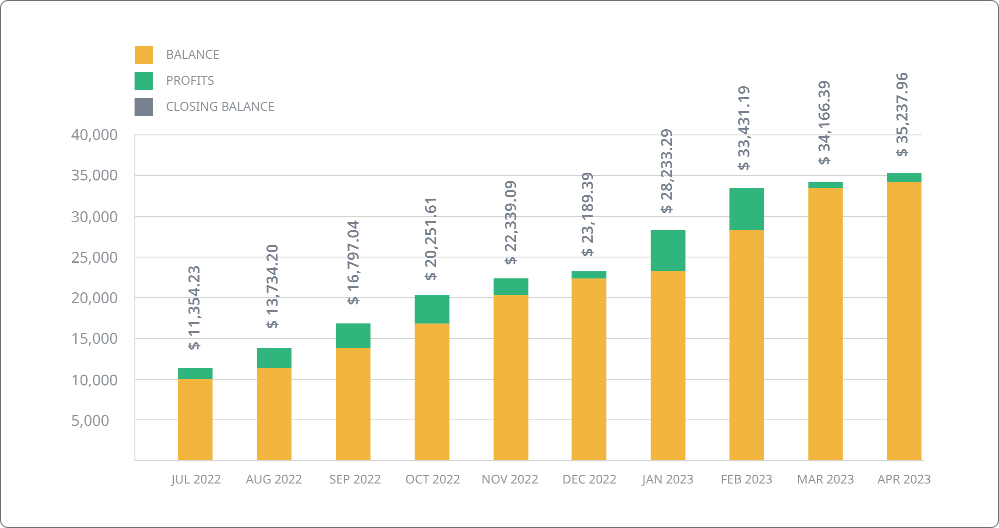

After 9 months of diligently tracking his trades Kyne has grown his account from $10,000 to $35,000 and is now confident that trading with ProfitFarmers can help support his needs.

But he’s not planning on stopping there:

Kyne’s injury meant that he has had an insurance court case hanging over his head for a long time now, but he wanted to spend as much time as he could learning new skills to prepare himself for life after whatever settlement would come his way, regardless of whether his injuries could heal or not.

We’ll briefly cover his multi-year trading journey along with all the learnings from his paper trading journal (download a copy below) so that you can skip directly to making profits without delay.

Be inspired, make trading your side hustle

The power of our ‘Pro Trader 5x Blueprint’ training plan

How little time it takes to trade profitably when using our platform

Learn how Kyne achieved these results (so you can copy them!)

Life Pushed Kyne to Find New Income Streams

Like so many other people before him, bad luck had left Kyne in a tricky situation. How could he make an income without being able to do the job he was trained for?

“I probably won’t be able to get back into electrical work anymore so I needed some other source of income”

Before finding ProfitFarmers, Kyne tried out some other trading services to get a feel for whether it was the right move for him. Unfortunately it didn’t work out too well:

“I started trading around 3 years ago where I found an Australian website which gave you the basics of trading and showed me how to read candlestick patterns and the charts. I would trade support and resistance levels but there was always so much chop in the market I would lose a lot of trades”

Kyne Needed a Genuine Solution That Would Also Fit Into His Routine

Making a profitable online side hustle isn’t always easy, especially if time is not on your side.

“Due to the court case I am going through I never had that much time on my hands during the day as I was off to one appointment after the next. Physio, hydrotherapy, endocrinologist, neurosurgeons.”

Fortunately Kyne came across ProfitFarmers whilst he was searching for signals or trading bots that could help him make trading less time consuming and more productive.

“I joined ProfitFarmers because I did not have time to look at the charts and I wanted to see if your platform would work for me once the court case is over”

Kyne signed up with the intention of testing the platform out for a long period so he would be ready for action as soon as his court case was over with. Here’s what happened next…

Kyne Went Through Our 5X Blueprint Training Plan

At ProfitFarmers we provide more than just trading signals, we also provide education and community to help ensure everyone has the best chance of success no matter their trading experience level.

- How to use the copy-trading platform

- Risk Management 101 (stop losing too much!)

- Risk:Reward based trading (stop gambling!)

- How to be a long term profitable trader

- Setting long term trading goals

- And more

You can get access to this course for free when you sign up! Not only that, but if you join our discord community we will give you even more training, entirely for free! You can find all the details on how to join inside your dashboard.

“My favorite features would actually be the videos you and your team do. You keep teaching us which is awesome! I learnt Elliot Wave and Smart Money Concepts which is way better than just entering random trades”

THE PRO TRADER 5X BLUEPRINT - FREE WITH YOUR 21 DAY TRIAL

The trade wizards behind ProfitFarmers have created the ultimate crash course in becoming a long-term profitable trader. Combined with our software, this gives everybody (beginners and advanced traders) the opportunity to start making some real gains from the crypto market.

So What Does a Day of Trading Look Like for Kyne Now?

With all of the knowledge in place, Kyne was ready to push on with his trading experiment. Thankfully he quickly realized that trading with ProfitFarmers was no trouble at all, even when he was rushing around in between all of his appointments.

“It does everything for you when linked to Binance. Literally put the amount of money you would like to on the trade and limit your risk by placing a stop loss and that’s it.”

“[When I was out and about] I would place the trades on my mobile and then would watch them play out and update the spreadsheet tracker on the weekends.”

“[At home] I just watch the trades on my left monitor while I sip some tea and watch some breaking bad”

Kyne’s Results After a 9 Month Long Paper Trading Experiment

We’ll leave it to Kyne to make it clear:

“People can’t say that your platform doesn’t work!”

If you want to see exactly which trades Kyne took and how much profit and loss each one made you can download a copy of his trading journal here.

9 months worth of trading data confirms that with a straight forward plan and some patience, anyone can start generating an income from trading. Kyne set out to prove a point to himself. Job done!

If you want to learn how to do the same, join our community Discord server where we run regular sessions covering how to use the platform and how to apply the learnings from the 5x blueprint just like Kyne did.

Kynes 3.5x (soon 5x) Trading Blueprint

Ready to benefit from Kyne’s hard work and diligence? Ok here’s the secret sauce…

Drum roll….

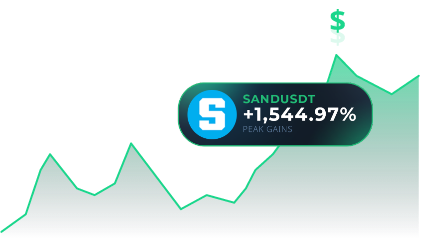

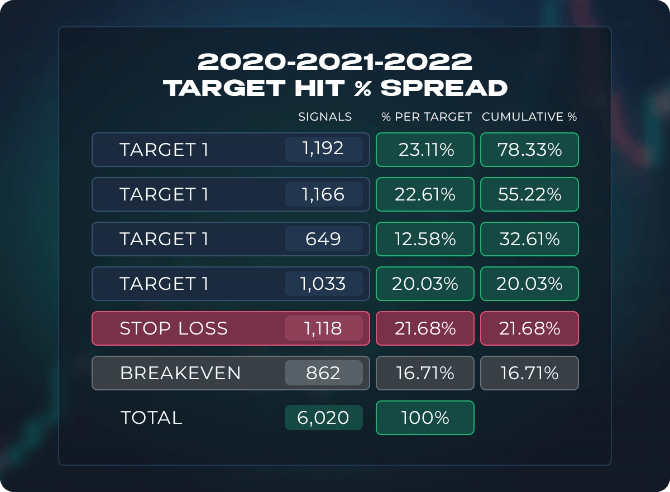

There is no secret! Kyne is literally just following the learnings from our 5x Blueprint and making use of the trading signal data we share publicly every month and year to guide some of his decisions.

Inside the 5x Blueprint you will learn that MATH (and consistency) is actually what profitable trading is all about. Our powerful Risk:Reward trading features combined with our high win-rate signals mean that anyone can trade effectively, as long as they are patient and stick to a plan.

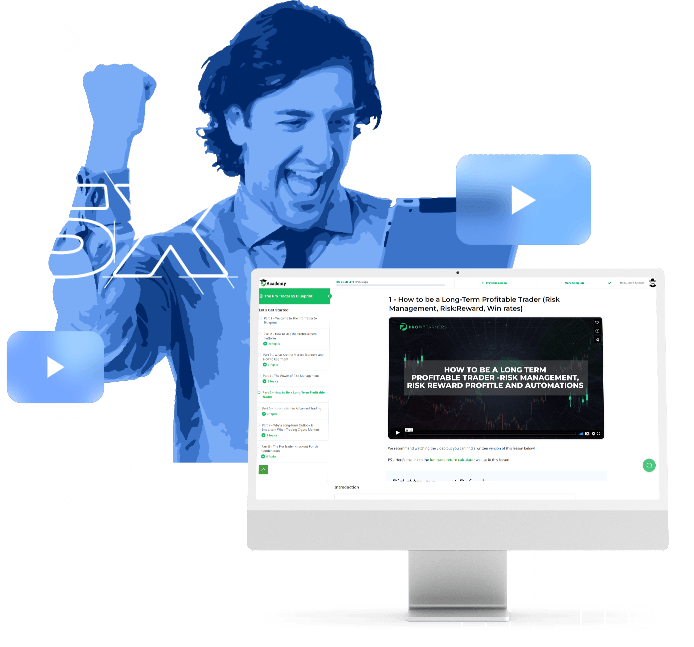

When trading signals arrive you have to make a couple of decisions, how to enter the trade (what price are you happy to pay for the coin) and how to exit (what price(s) will you sell and do you want to move your stop loss). The system suggests all of these for you, but ultimately you can customize things to suit your own plans if you want!

Here’s how Kyne did it…

Entering Trades

The good news is that none of this requires you to be a rocket scientist. But fair warning, if you haven’t used our platform before this may all sound a bit confusing. Don’t worry, if you sign up we’ll teach you everything you need to know and you can get free tuition from our resident trade doctors inside our discord group.

“So at first I was just jumping into the signals and using the laddering method until around November or December.[So for the first 3-4 months of trading] I did no technical analysis at all.”

What’s impressive about this is that Kyne grew his balance from $10,000 to $20,000 during that period. That’s a 2x without needing to know any technical analysis! You can check Kyne’s month by month (or trade by trade) progress by downloading a copy of his trading journal above.

By the way, Laddering mode is a feature that splits the suggested entry zone into 5 parts so you can average into your trade if you aren’t sure about a specific price.

“So I laddered in on the first, second and third [entry] zones. Placed stops at entry four or five and sometimes even at the designated stop loss levels if my risk was not too large.

The laddering was with random trades. I think I did that for about 3-4 months and then after that I would just place a market order when I saw signs of the market going back up.”

Kyne was experimenting with making his stop loss ‘tighter’ to minimize his risks. The reason for doing this is that statistically, many winning signals don’t see price come much deeper than half way into the suggested entry zone. So it’s reasonable to move your stop loss up a bit closer.

“Then I started to actually look at the charts and I would wait for an entry. I don’t like risking a lot on each trade so I limited my stop loss to very minimal.”

“To be honest, for most of the trades I just placed a market order.”

Placing a market order is the most simplistic approach as you just fully buy into your trade at the current price. This is actually totally fine for beginners because the signals have such a high win rate. All you need to do is ensure you are taking trades where you stand to gain more than you are risking losing.

This difference between possible profits and possible losses is what we call Risk:Reward (R:R) ratio. We explain all of this during our training sessions and to make it even easier, the platform shows you your R:R during each trade setup.

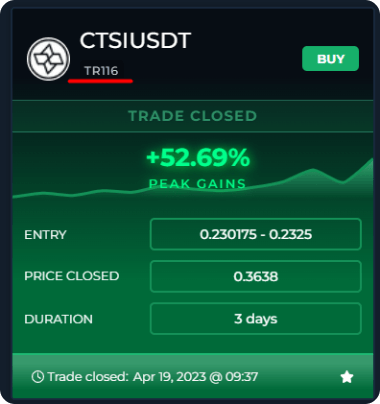

“With tr116 trades I would just jump in when the trade was the in the entry zones and put my stop loss at the designated area because the risk was low. Now I wait for the market to hit the lower entry points like 3, 4 or 5 and place the stop at the designated zone.”

TR116 is the code for one of our current signal algorithms. We update and create new ones all the time based on market conditions. TR116 is known for having very precise entry zones with a tight stop loss, but great rewards on higher targets.

Exiting Trades and Banking Profits

Kyne has shown us that you don’t need to have a genius plan for getting into the trades and if you are unsure, you can always turn on laddering mode. But what about taking profit? How did Kyne manage to earn so consistently?

Once again, the answer comes from sticking to the overall signal statistics…

“So I normally go through that pdf I made of the signals and look at the average percentage it moves. Then I plot that on the chart and if it lines up with Take Profit Target 1, 2 or 3 that’s where I set my entire take profit amount”

You can access the lifetime win rates and average gain statistics for all signals from your dashboard.

“I normally go for Take Profit 1 and Take Profit 2. I hardly ever aim for Take Profit 4. Most of the time I’m happy at Take Profit 2… I like taking profits because altcoins are very erratic. I want to lock in my profits!”

Historically signals reach target 1 around 70% of the time and target 2 around 50% of the time. By focussing on the lower targets you can achieve a great win rate! Combine that with good R:R setups and you have the magic formula for long term profits!

“Then I will use market structure and basically follow the trend. If it starts making lower lows and lower highs I pull the trade in profit.“

If you don’t have time to follow the charts like Kyne suggests, our system automatically follows ongoing trades and can close them early if the system thinks the trend is failing. That feature is called Trade Guardian. It means you can sleep without worrying about all your ongoing trades.

What We Can Learn From Kyne’s Trades

If you’re just starting out with ProfitFarmers then Kyne’s trading model gives you a fantastic starting point. You can take confidence in the fact that Kyne didn’t need to do anything complicated to achieve amazing results.

- Enter trades which have a good Risk:Reward

- Aim for targets that are hit frequently (1 and 2)

- Don’t risk too much on each trade and keep your trade size consistent

- Be patient and selective AKA stick to your plan

- Don’t let emotions get in the way

“I have watched a lot of YouTube and some people trade large amounts with no stop loss and get wrecked. I’ve seen the same on your [ProfitFarmers] platform, some trial users take $5,000 and place $1000 on 5 trades at x50 leverage and boom, they lose it all. Suddenly it’s ProfitFarmers fault. ‘Stupid platform. I was hoping to make 50k off those 5 signals’. Don’t be that guy!”

Kyne’s approach is a very healthy balance between speed of gains and risks taken. Notice that he has explained how he would try to capture some trades by only entering on the lowest entry levels. This would mean that sometimes he would miss some good trades that other people did actually buy into! But for Kyne it was better to miss a trade, than take on more risk.

As you develop your skills you will become better at balancing your risks and identifying which signals are golden and which you would ignore. So if earning a 5x on your account in 1 year isn’t fast enough, don’t worry, there are always ways to improve!

The Pro Trader 5x Blueprint covers all of this in more detail and our trade doctors are waiting to talk with you 1 on 1 or in group sessions inside our Discord community. ProfitFarmers has been running for multiple years now with a great track record, maybe it’s time you gave it a try!

There is nothing standing between you and your own 5x journey.

Sign up now!