Crypto RSI Scanner: Quickly Spot High-Probability Trades With Our Crypto RSI Screener

Instantly spot high-probability price action WITHOUT needing to research or flip through charts. Our RSI indicator analyzes 300 coin pairs across 8 time frames and helps you find trades faster than ever.

What is an RSI Screener?

An RSI screener is a timesaving trading tool that highlights overbought and oversold assets, helping traders quickly spot high-probability price reversals and make profitable trades.

Here’s how it works…

There are times when people buy too much or sell too much of a coin. When that happens, there’s often a correction – meaning the price moves in the opposite direction. If it’s being bought too much, it’ll drop. If sold too much, it’ll rally.

These reversals are some of the easiest, most reliable gains in the entire crypto trading world. What our screener does is highlights interesting price actions and shows you when a reversal might be coming. It’s not 100% guaranteed to happen – nothing ever is – but it just points it out and says “hey you, look here. There might be something interesting going on”. This saves you from having to constantly research and monitor the market looking for interesting price action (which could take hours and hours).

If you find yourself struggling to make winning trades, our RSI scanner will help identify winning trade opportunities quickly without needing to do much research or technical analysis (though you should still do as much as you possibly can).

Benefits of Using a Crypto RSI Screener

This tool helps you find high-probability trades in very little time, and all without needing to know technical analysis or look at any charts.

This is an entire day’s research in a single snapshot.

There are tons of benefits for traders. Including:

- Stop wasting hours a day flipping through charts and missing trades

- Stop getting killed on trade after trade and actually start making gains

- Stop playing guessing games and start making high-probability trades

- Stop analysis paralysis and actually execute profitable trade more frequently

How to find profitable trades with the RSI Scanner

You can find interesting trade opportunities quicker than ever before, and it’s actually quite straight forward.

To use the RSI scanner effectively, you need to understand the two key concepts: Overbought and Oversold

Overbought

Overbought means that the price trend may be entering a cool-off period (the price may pullback)

The higher the RSI goes above 70.00, the more overbought the asset is… and the more likely that the price could go down.

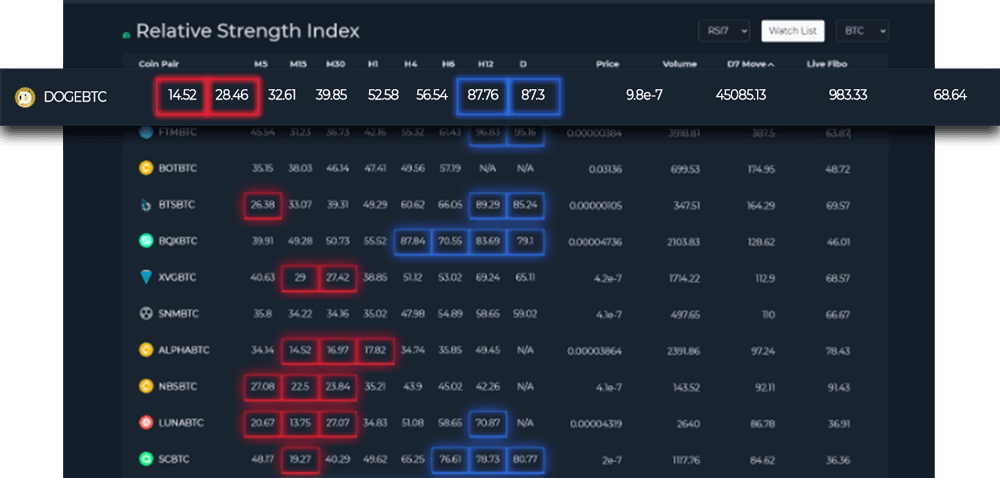

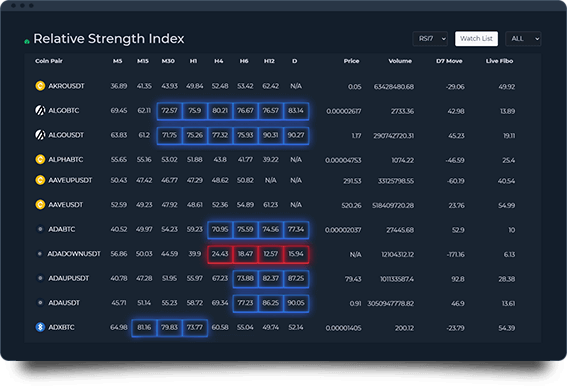

In ProfitFarmers’ RSI scanner tool, overbought coins are highlighted in “blue”

Oversold

The RSI can also signal when the plummeting price may reach exhaustion by returning an “oversold” value. The lower the RSI goes below 30, the more oversold the asset is and the more likely it’ll reverse in price.

In ProfitFarmers’ RSI scanner tool, overbought assets are highlighted in “red”

How Overbought and Oversold Looks on a Chart

Overbought and oversold are very good indicators that a pullback or reversal may be in place. This doesn’t mean that you should use this as the only basis for all of your trading decisions but do recognise its importance.

This is how RSI is represented on a chart (Below the MTLUSDT candlestick chart):

When MTL’s RSI breached above 70.00, it was overbought and saw a pullback (price went down).

Later on, when the coin reached well into oversold territory (below 30.00), a reversal (price went back up) occurred.

Divergence

This may be the most valuable part of RSI. Divergence occurs when the price momentum is different from the RSI trend. There are 6 divergence types:

Bullish Standard (Price = Lower Lows, RSI = Higher Lows)

When you’re looking at bullish trends, you’re always looking at the lows (orange line). Between price action and indicator, you are always looking at what it is doing to the lows.

With OAXBTC chart shows that the price was making a lower low (went from the low price to an even lower price) while the RSI shows higher lows (the price went from low to high).

This suggests that the price may be due for a trend reversal within the next hour or so as shown in the example.

Bearish Standard (Price = Higher Highs, RSI = Lower Highs)

Contrary to bullish trends, you look at the highs when you’re checking out bearish trends.

In the ETHUSDT chart example provided, we can see that the price was in an upward trend while the RSI is trending downwards. This indicates that the price may be about to go down.

IMPORTANT: RSI divergence is a powerful trend indicator but you must set your expectations based on the time frame you chose.

For example, if you found divergence using the 1-hour chart then expect that the trend may appear within the next few hours.

How to use ProfitFarmers’ RSI scanner?

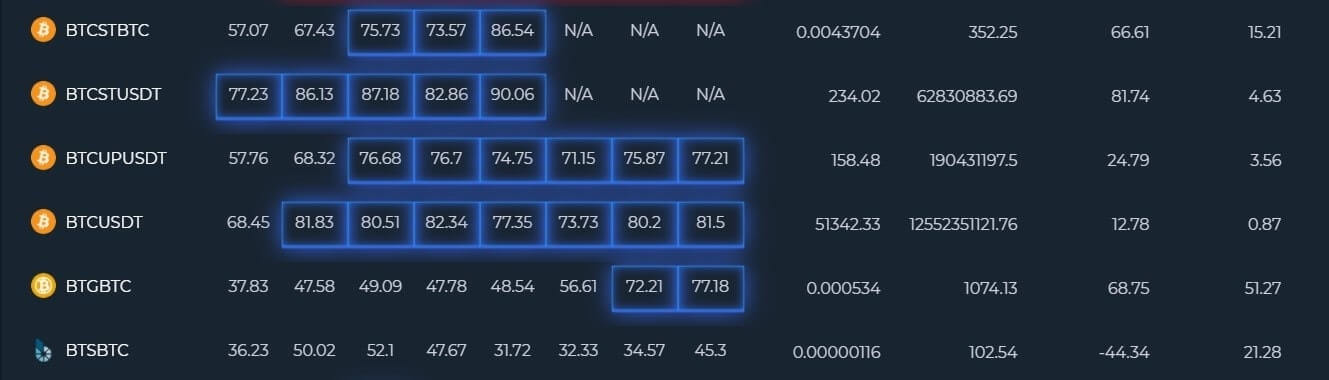

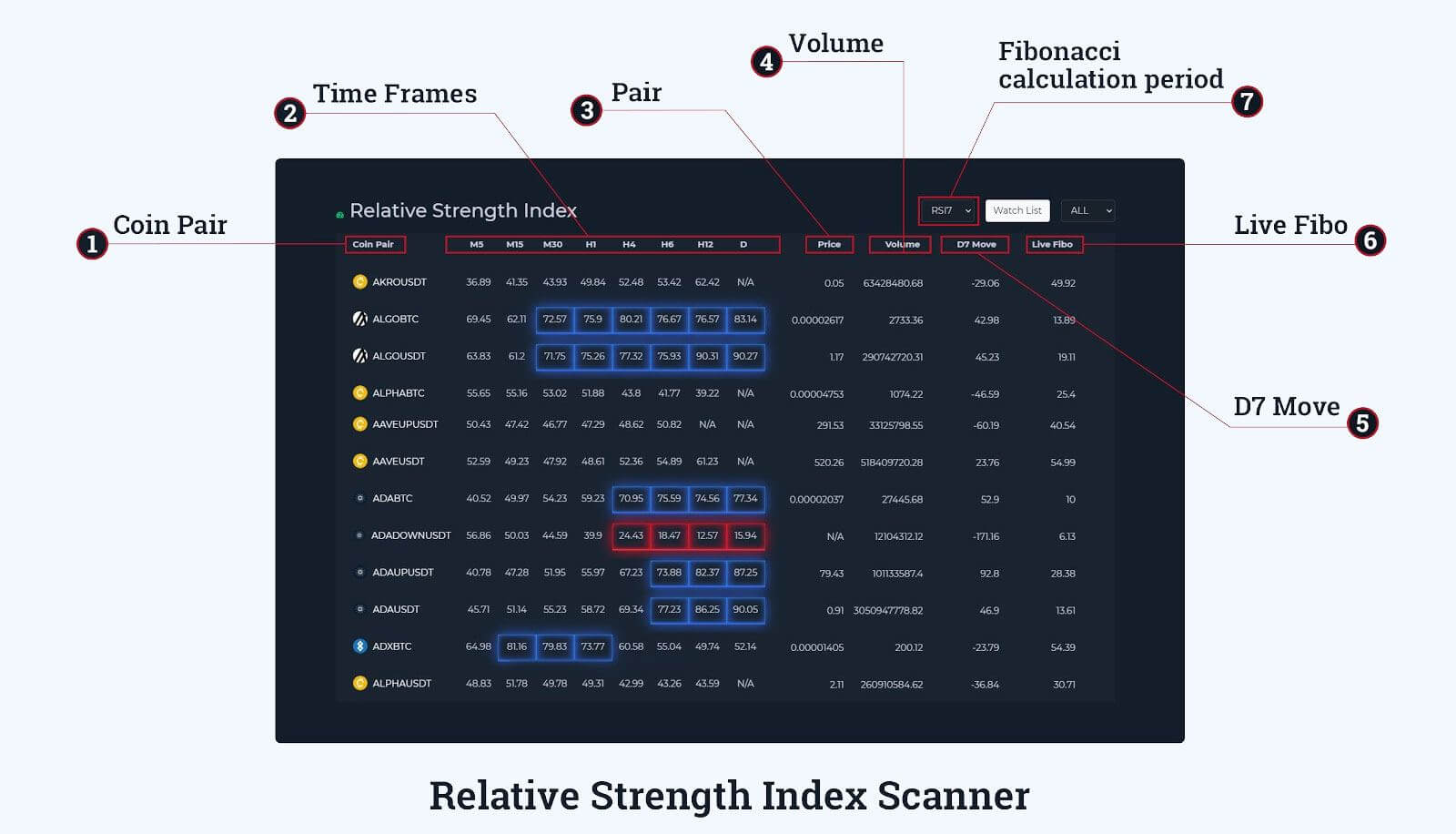

- Coin Pair – The given coin pair

- Time Frames – The 8 different time frames. M stands for minute, H for hour, and D for Day. M5 stands for 5 minutes, H1 stands for 1 hour, and so on.

- Price – Current price of the coin

- Volume – How many coins are in circulation.

- D7 Move – Price movement in 7 days

- Live Fibo – Fibonacci retracement levels at the chosen time

- Fibonacci calculation period – Time frame of the Fibonacci retracement

Confluence with the Price Action Scanner

As previously mentioned, the overbought and oversold shouldn’t be your only basis for thinking that a trade looks interesting. You can confirm the trend if you check the Price Action Scanner (PAS).

The PAS lets you know about the Price Action Trend. If you find that the RSI and Price Action of a particular pair coincide, it may be a good idea to pull up its chart and confirm it.

This will save you a lot of time because you’ll be able to easily identify trades that offer potentially profitable opportunities.

Here’s an example of Confluence:

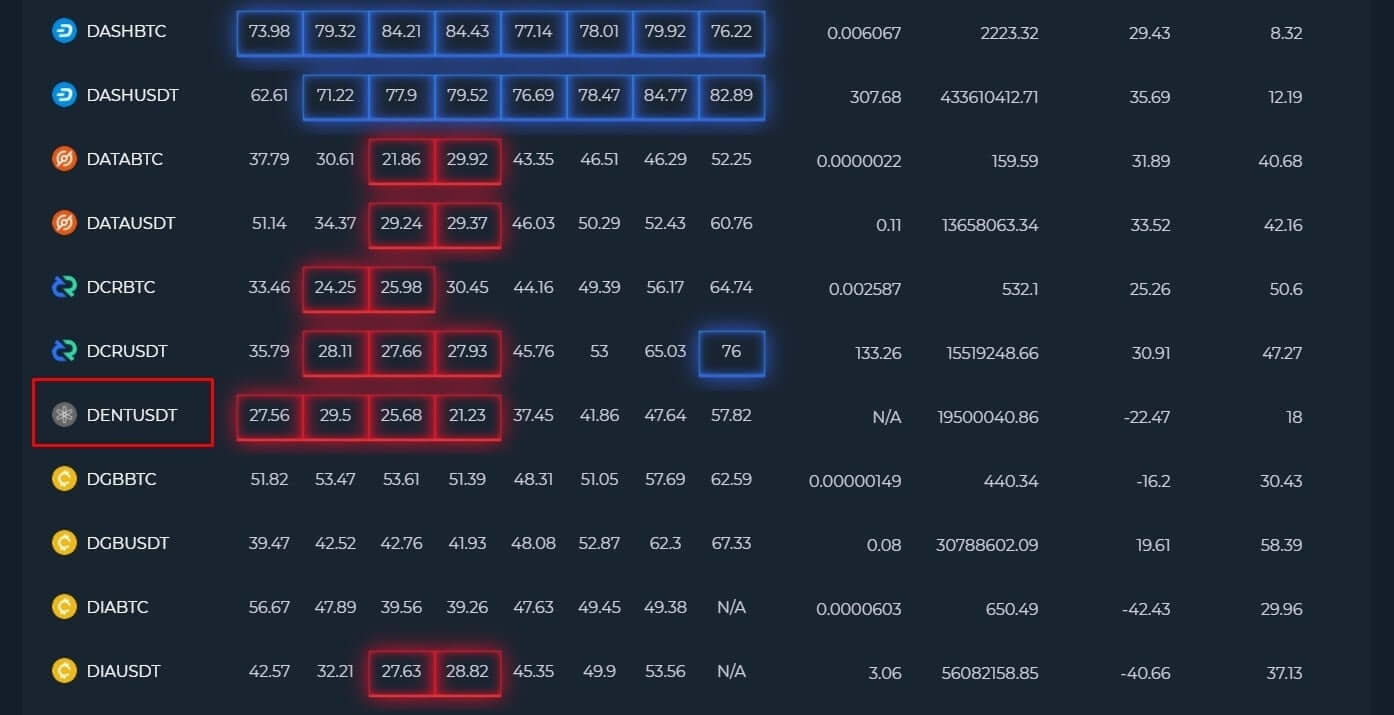

On the RSI scanner, DENTUSDT is oversold on the 5, 15, 30-minute and 1-hour time frame.

When we look up DENT on the PAS, we can see that there’s a little bit of a pullback but the price is trending up so it may be interesting to buy DENT on dips.

It might be worth it to pull up the chart and see if you can make a trade:

In this example, we saw that there was a pullback and that forms our support. You can set your stop-loss a little below the support level, buy the dips, and sell when the price goes up.

Here’s a look at the DENTUSDT chart three days later.

As you can see, the price dipped down a bit then quickly skyrocketed in price!

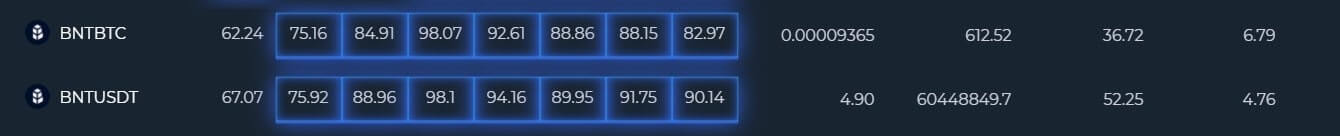

Quickly see which coins are trending up in price but sitting in Overbought territory

Using the RSI scanner, we can quickly see which assets have been overbought. In the image above we can see the BNTBTC trade has been overbought across time frames except for M5.

If we go to the BNTBTC 15 minute chart:

This indicates that there may be a trend reversal coming and it may be best to adjust your trades in anticipation of the pullback.

Here’s the same chart 3 hours later:

As you can see, the price pulled back.

Quick scalping and swing trades with trend plays on lower time frames

If you’re looking to make short term trades, consider looking at the RSI Scanner’s 5, 15, and 30-minute time frames.

Here’s an example:

We can see that the OAXBTC has been oversold in the 5 and 15-minute time frame.

Those looking to scalp may be interested in buying OAX at this moment because there’s a good chance that a reversal is coming.

You can confirm this by looking at the Price Action Scanner (PAS) and the chart:

OAXBTC is looking bullish (green) on the PAS so it would be interesting to jump into a trade expecting that the price will go up.

When we pull up the chart, it confirms that the price is indeed trending upwards.

You can use this strategy if you’re planning to trade coins with leverage. Find some coins that may be trending up and do a quick scalp.

For example, if you took a position and made a 3% gain but you traded at 10x leverage, then you’ve got a 30% gain overall.

Live example

Here’s how you can use our RSI scanner and PAS to identify interesting trades.

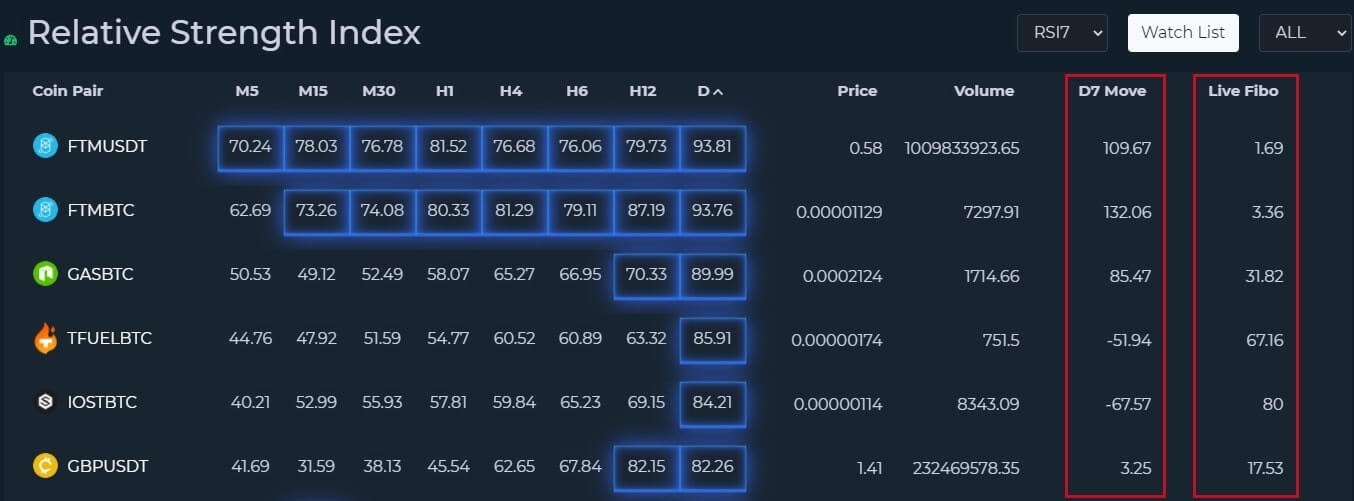

Step 3: Look for coin pairs that have made drastic moves on the D7 and above 25%-50% on the Live Fibo

In this example, we can see that ZRXUSDT moved 100.3 % within the last 7 days (D7) and its current retrace level is at 49.58% (Live Fibo).

At this point, you may want to check the Price Action Scanner for confluence.

Step 4: Check the Price Action Scanner (PAS) for Confluence

The PAS suggests that there may be a downward trend on almost all time frames with small upticks on the 5 minute time frame.

At this point, we’ve confirmed through the RSI that the coin is overbought and the PAS is suggesting that the price may pull back soon!

It could be worth pulling up the ZRXUSDT chart to see if there are any interesting trends or divergence.

RSI Screener Summary

- Our RSI screener helps you identify interesting price action at a glance and spot potential price reversals without needing to do much research or look at charts

- Look for trades with a good peak gain and trades that are trending in the higher timeframes.

- The RSI scanner is best used with other technical analysis tools, like the Price Action Scanner (PAS). The more research you do the better your results will be.

Be more profitable and start making trading work for you again.

Join ProfitFarmers and:

- Easily execute trades like an expert

- Frequently find more profitable trades with less time

- Take your life back and actually ENJOY the journey of trading!

- Cure the emotions & FOMO that cuts into profitability