It’s time for the last quarterly ProfitFarmers news covering October, November, and December of 2020.

or

Trading Signal Statistics - Headlines

Our algorithms generated over 552 signals in 92 days (3 months) across the various strategies available in our arsenal.

That’s an average of 6 seed signals closing every single day for our members all around the world.

When we broke down the winners and losers, we saw a massive 82% of them hitting at least target 1! That’s 4% higher than our previous quarterly result!

455 out of 552 (4 out of 5) signals offering up at least some profit potential! Only around 18% (97) of our signals generated and vetted by the experts went directly to stop-loss.

Trading Signal Statistics - Full Breakdown

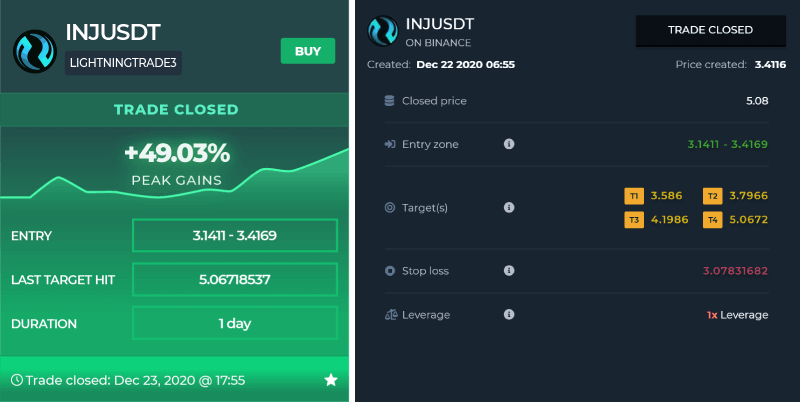

Best trade for the quarter

We can see from the chart that the price dipped just around 15-20% from the top of our entry zone before quickly picking up momentum and hitting target 1 and target 2!

Afterwards, we saw a period of sideways action where the price ranged around 10% for 5 hours then skyrocketed – hitting target 3 and eventually target 4.

Interestingly enough, our best trade for the quarter is also the best trade for the month of December.

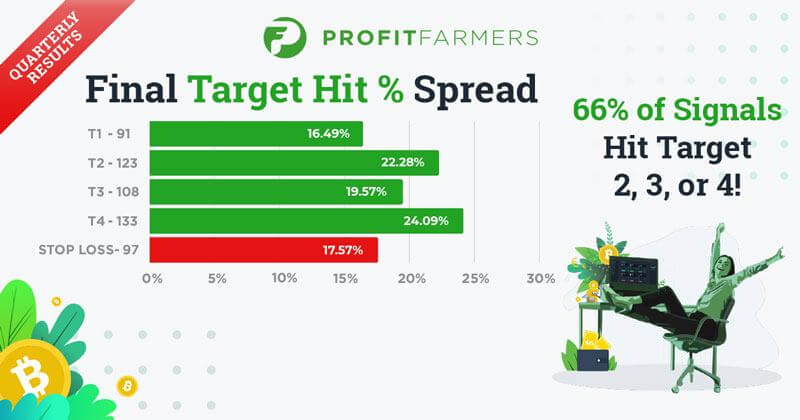

Target spread and profit per target

We’ve broken down the winners to discover which targets were being hit. This is what we saw:

An amazing 66% of our signals hit targets 2, 3, or 4! That’s 5% more than the previous quarter!

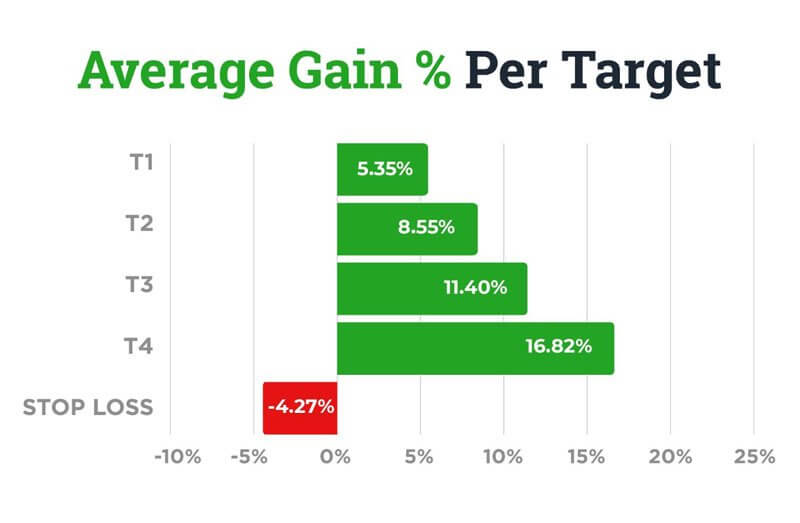

What’s even more amazing is that the average gains from each entry looks like this:

In summary:

16.49% (91) of our signals hit target 1 and made an average gain of 5.35%

22.28% (123) of our signals hit target 2 and made an average gain of 8.55%

19.57% (108) of our signals hit target 3 and made an average gain of 11.40%

24.09% (133) of our signals hit target 4 and made an average gain of 16.82%

Only 17.57% of our signals went directly to stop-loss.

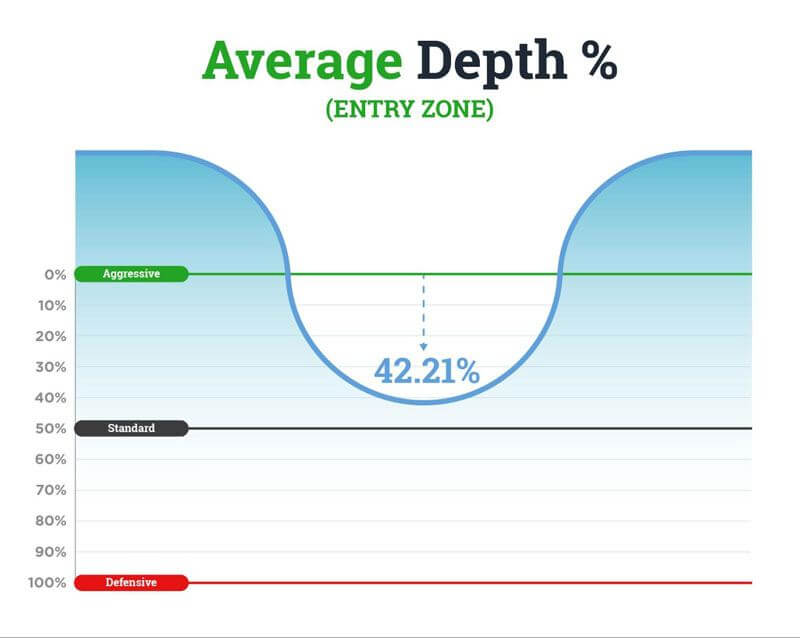

This is the average depth percentage for the last quarter. As expected, it just dips above the standard strategy because of how bullish the market was around this time. The best ‘average’ play was to buy a little higher than the middle of the entry zone.

Average depth for October- December 2020

We’ve seen these past few months, the market has been very bullish which resulted in the price not quite hitting the middle of our buy zone.

For this period, the best ‘average’ way to get into the trade is to set your entry price just above the middle of the entry zone. We’d like to point out that this doesn’t indicate any future trends.

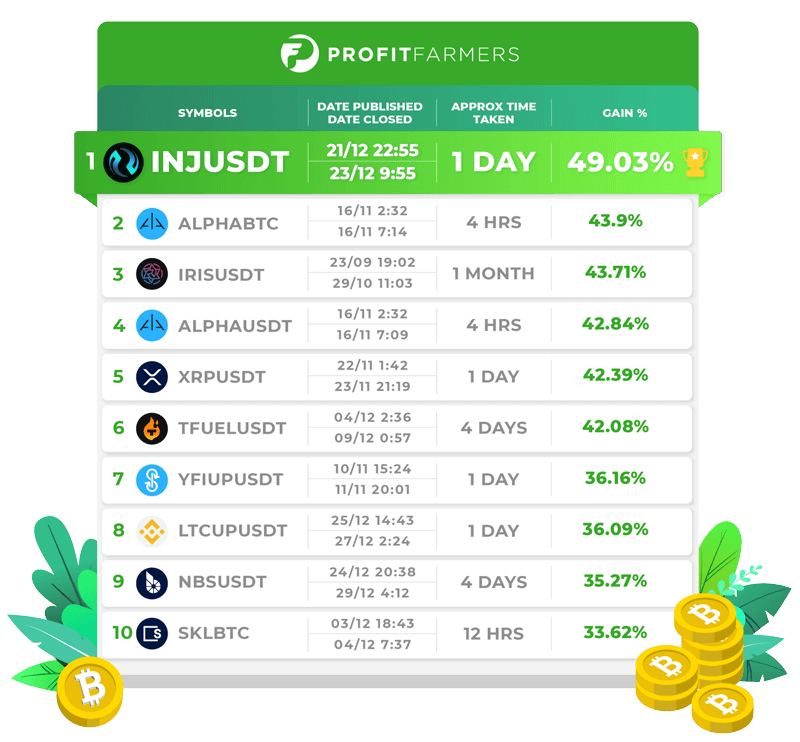

Top 10 Trades for the Quarter

INJUSDT, our best trade for the quarter, achieved an impressive 49.03% peak gains within a day!

Honorable mention goes to ALPHABTC for achieving a whopping 43.9% in just 4 hours!

We have a good mix of coins here. One thing we’d like to point out is that 5 of the top 10 trades were created and completed within the month of December! It truly was a bullish month for crypto!

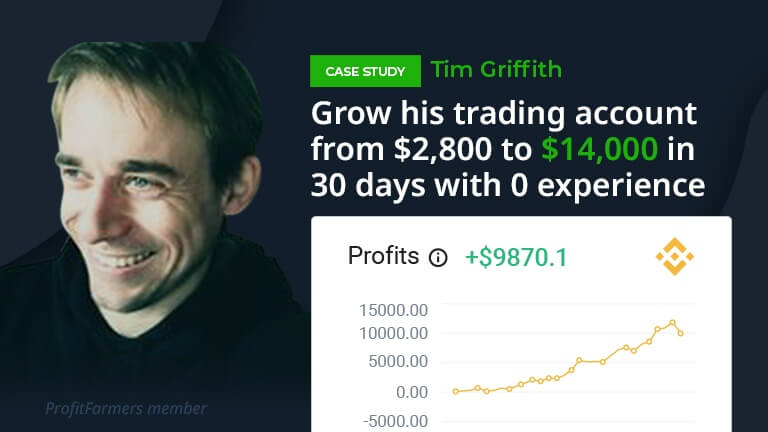

Be more profitable and start making trading work for you again.

Join ProfitFarmers and:

Easily execute trades like an expert

Frequently find more profitable trades with less time

Cure the emotions & FOMO that cuts into profitability

Take your life back and actually ENJOY the journey of trading!