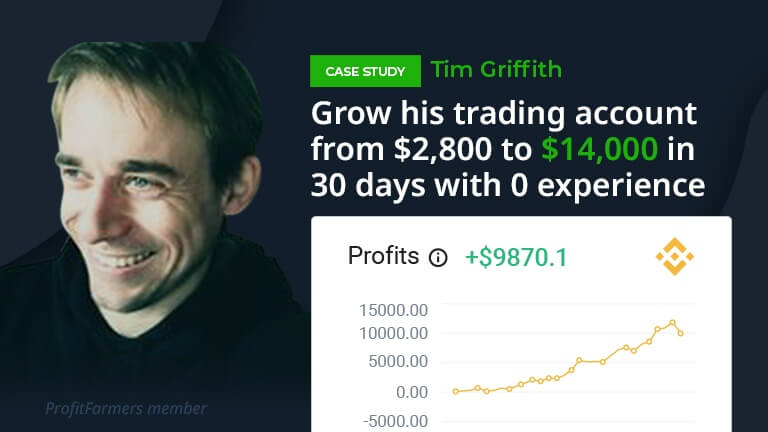

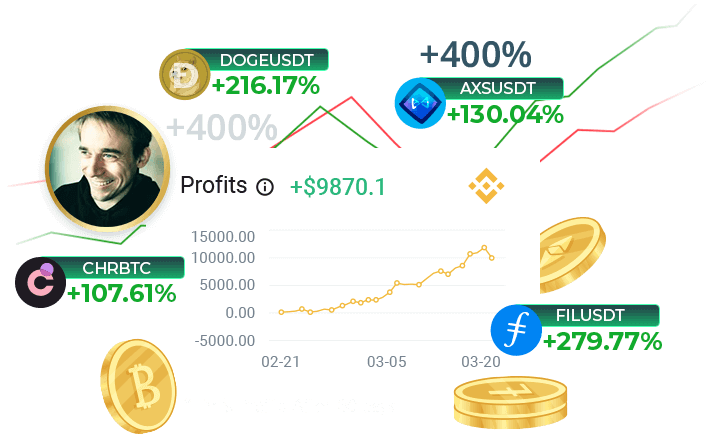

Tim Griffith

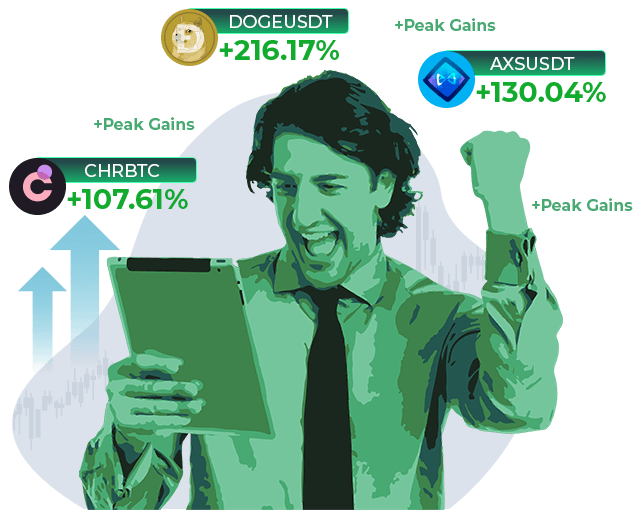

How ProfitFarmers helped Tim grow his trading account from $2,800 to $14,000 in 30 days with 0 experience

When Tim Griffith, a 40 year old mental health nurse, joined ProfitFarmers he never would have guessed he’d be saying this, just 1 month later:

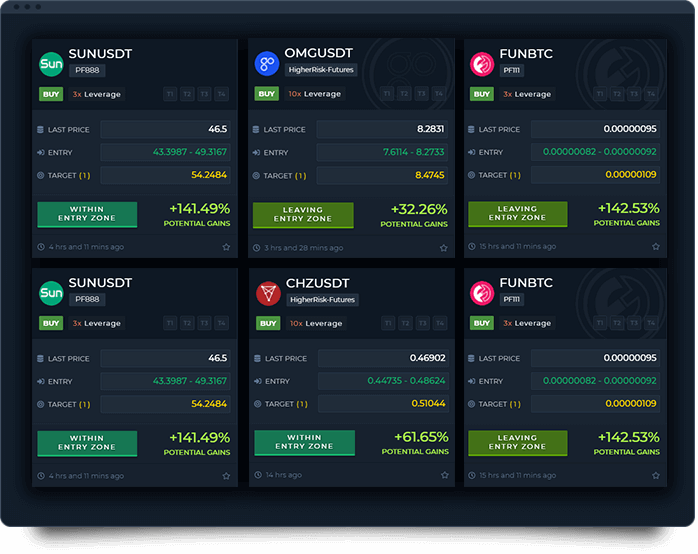

+400%

Profit Gain

+$11,200

Additional Profit

$2800 to $14000 in the last 30 days... that's 400%!

I could be retired by the Summer!”

Tim's Gains in 1 month

Read on to find out exactly how ProfitFarmers helped Tim go from trader zero to trader hero almost over night.

ProfitFarmers Is Now 100% Free

ProfitFarmers, an all-in-one crypto trading platform that lets anyone trade like a pro, is now 100% free to use.

Open an account, connect your Binance.com, and start trading – you can get started immediately for $0.

Meet Tim

Like so many of us, Tim didn’t walk straight into a 9-5 office job after finishing school:

“I didn’t become at all career orientated until my early 30’s, up until then I spent time in low pay, low responsibility jobs, some travelling and working abroad in ski resorts and so forth – generally having a whale of a time and trying to make the most of my youth!

As you can imagine this left little room for earning or saving money, so that’s why I initially started looking into trading, to try and compensate for lost time!”

Why Tim joined ProfitFarmers

To make the most of his available time for trading

As a mental health nurse, looking after vulnerable people, Tim doesn’t always have control over his free time:

“I do 12 hours shifts usually 4 days a week – so a work day means getting up at 0600 and getting home at 2030.

As I’m not a morning person, I usually don’t get time to scan the trades first thing. I usually wait for tea break at around 9 or 10.

I am lucky in where I work though, as I get the opportunity to have a look at things every couple of hours or so.”

To easily pick out the best trades

Tim knew enough about trading to get started and make some moves, but finding the best trades through technical analysis was a stretch too far:

“I have a little experience in trading, I understand what’s going on with candlestick charts etc- however it is interpreting these charts to find good trades that I have less understanding of”

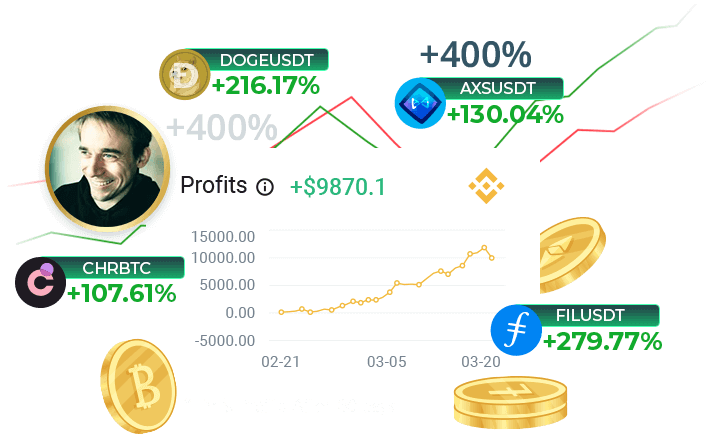

By using ProfitFarmers semi-automated copy-trading features Tim was saving huge amounts of time.

But extra time alone does not make a trader profitable…

That’s where ProfitFarmers premium trading signals come in. Produced by our trading algorithms and experts, our signals allowed Tim to spend all of his free time focussing on the best trades available to him.

Easily copy signals on ProfitFarmers Dashboard

feature of your service that is one of the most

appealing aspects”

ProfitFarmers Is Now 100% Free

ProfitFarmers, an all-in-one crypto trading platform that lets anyone trade like a pro, is now 100% free to use.

Open an account, connect your Binance.com, and start trading – you can get started immediately for $0.

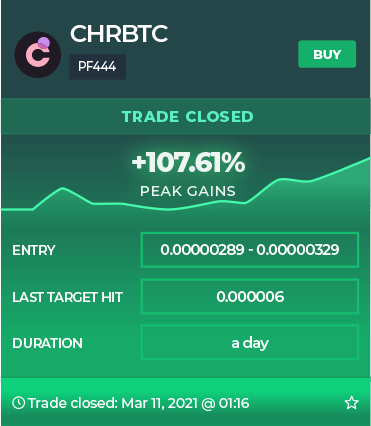

The challenge - making more gains!

Tim routinely missed very profitable opportunities simply by being too cautious, as well as having an approach that was just slightly too simplistic. His unoptimized strategy was consistently resulting in more than half of his trades being unsuccessful.

Sick of missing out on all the winning trades, Tim reached out to us…

“I seem to be having trouble being profitable”

Well that’s not what we wanted to hear!

Tim, all credit to him, had already identified a couple of problems:

“When I first started [using ProfitFarmers], I followed some signals that were several days old, but still within the entry zone (the price range we recommend to buy the coin), all of which failed – I wonder if perhaps this is not an advisable tactic?

I’ve been following what you label as the “standard” entry point in the middle of the entry zone, and finding that more than half of my trades are stopping out, and at the same time seeing dozens of other trades that I’ve not entered going on to hit take profit targets.”

I’ve gone back and analysed dozens of trades over recent days, and it seems that the profitable trades, more often than not, don’t go down very far into the entry zone, which is why I have not been able to get into them.

“So, it seems the strategy I have been using has been heavily reducing my chance of hitting successful [trades], whilst greatly increasing my chance of following the unsuccessful ones?”

It quickly became clear that Tim needed to optimise his approach if he wanted to attack these fast money signals and come out with gold and glory.

The solution - Simple Refinement

The platform does so much of the heavy lifting already (research, market updates, semi-automated trades, notifications etc.) that all that was missing was a nudge in the right direction.

We explained to Tim that many of our most successful users treat the signals like a roadmap. They are a fantastic starting point but for maximum rewards it can pay to add some refinement.

That starts with focusing on the right trades for your style. The signals are generally divided into 2 categories:

Tim liked the fast moving signals and given his work schedule it made sense that he focus on trades that take just a little bit of tweaking and time. Something he can pick up and run with whenever he has a few minutes spare and fresh signals are coming in.

me rich overnight with no effort on my part,

I think with some adjustments to how I use the

signals I can be profitable”

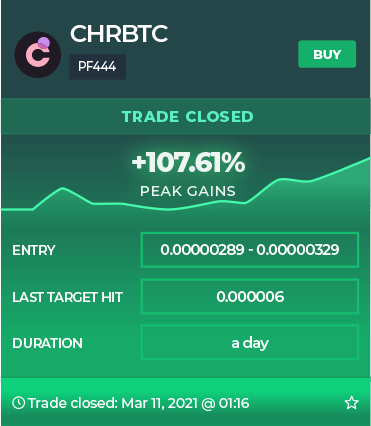

We regularly break down the signal results and can see that fast moving trades often don’t make it all the way down to the halfway point of the entry zone. Tim simply needed to adjust his tactics to suit the type of signals he was copying and start entering more aggressively. To offset this, Tim also began to raise his stop loss to a higher value than the standard.

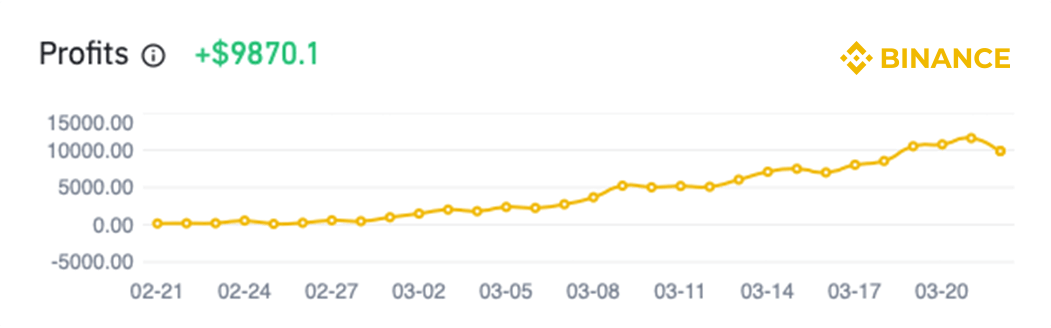

The Results

11 days passed and we were beginning to wonder what had happened to Tim. That’s when we got these messages:

“I am looking at my account today and I currently have a 100% profit. Almost exactly. I am pinching myself. At the start I would have looked at a profit of 20-30% as very good.

My starting capital was actually a bit less than your recommended minimum (about $2700). I do not have a lot, or to be honest really any money. This is something that I am hoping can be genuinely life changing for me.

I don’t expect to be doubling my money every month, but I could not be any happier with how things have started.

Naturally we were thrilled for Tim. This is why we exist! But it didn’t stop there…

5 days later we got this:

“At the time of writing my return on initial investment stands at 187%. Throw into the mix the fact that when I first messaged you guys for help a little over 2 weeks ago I was hovering just above break even, that seems quite remarkable!”

Urghhhhh, Tim clearly seemed to be on fire at this point and finding his rhythm. We thought that was good but…

10 days went by and then we heard from Tim again:

“Hi Team, Still killing it with the trades – gone from $2800 to $14000 in the last 30 days… that’s 400%! I could be retired by the Summer!

Here’s to more of the same 🙂

Tim Griffith

Member of ProfitFarmers

What's next for Tim?

“My plan is to start making withdrawals to coinbase once I reach £12,500 (so I can pay off my original investment and membership while keeping over £10k to trade with. This might even happen in the next week, shall have to wait and see), then on a monthly basis, withdraw up to half of profits and use the rest to grow my trading capital.”

We want to congratulate Tim again. Truly amazing results, you’ve really made the most of the platform and the crazy signals that we have been consistently delivering.

Cheers!

Now it's your turn.

Tim’s story is truly inspirational. It fully embodies why we wanted to create this platform…To make profitable trading something everybody can do.

The greatest thing about this story is that it proves that anyone can become a profitable trader, even with limited time and limited experience, by using the ProfitFarmers system.

We want you to be our next success story.

Sign up now and start your journey to trading stardom.

BONUS SECTION FOR SERIOUS TRADERS:

Learn Tim’s 5 ProfitFarmers trading tactics

(Warning, this gets detailed!)

1. Pick the right signals

ProfitFarmers’ trading signals are like Premier League football players; they all have the ability to perform like beasts through their own respective strengths.

Our signals have many different strategies powering them, with each strategy playing on a different trend in the market. Paying members get access to our signal strategy guide where we break down each strategy and explain what it’s looking for.

In the same way a football coach doesn’t put a player on the field at random, being selective and understanding the signals you’ll trade with is how you play to win. This is why we highly recommend members read our signal strategy guide. It’s located in our knowledge base

Tim’s strategy

2. Choose how much to trade with per signal

Once you’ve picked a signal you’ll need to decide how much money you’ll trade with. Pro traders often decide “how much” ahead of time so they can stick to a plan, but more on that further down.

Bonus tip: Pro-Traders typically don’t set a dollar amount to trade with, but decide on a percentage of their trading capital they can risk losing per trade. This is part of practicing good risk management, making sure your risk/reward ratios aren’t too wild.

Here’s what Tim chose to do:

“I’m being relatively safe by always using a trailing stop loss and tend to try to keep as much of my trading capital in USDT to guard against a BTC crash. I never risk more than 2% of my trading capital per trade (usually more like 1.3%).”

How to calculate your own trade size

In this simple example we show that you can make a trade for 50% of your account size ($5000 out of your $10,000) but actually only risk a loss of 5% of the account size or $500.

Account size: $10,000

Acceptable Risk: 5% (or $500)

Lets say you are planning to buy Litecoin-USDT at $100 with a stop loss at $90 (or a -$10 difference).

Take your trading account risk % amount and then divide that by your stop loss risk of $10.

$500 / $10 = 50

You can buy 50 Litecoin – at a total cost of $5000 based on the price of $100 per coin – on this basis knowing you can lose at most $500 of trading capital ($10 loss x 50 coins).

So in the example given here you could use $5000 on your trade without risking more than $500 on a full loss.

3. Enter at the right price, protect yourself with a stop loss

Our signals include an entry zone, AKA a price range that’s most ideal to buy the coin within. In our signal result blogs we show you how far into the entry zone prices dip (on average) on our signals. The entry zone is a key element to consider for 2 main reasons:

- You can miss getting in on a trade entirely if your entry price is too low in the entry zone, as the coin’s price might not dip down that low.

- You can massively reduce your overall profitability by overpaying for the coins by setting your entry price too high (or even above) the entry zone. This will also increase your risk factor if you leave the stop loss on it’s preset value.

How Tim picks his entry price

And how Tim decides on the right stop loss price

Another smart stop loss tactic from Tim

4. Take your profits at the right prices, don’t be emotional

Don’t let emotions like fear and greed mess up your profitability! A typical rookie mistake is to exit a trade early, only to see it shoot up another 100% afterwards. Or worse, they don’t get out of a trade on time and get left holding a worthless bag of coins…

ProfitFarmers makes this step much easier by including 4 recommended take profit targets in our signals. Each target also includes a preset percentage of coins to be sold.

Bonus Tip: Pro-Traders typically decide what percentage of coins they’ll sell at each profit target ahead of time, allowing them to stick to a routine when trading multiple signals and not wander off making bad emotional decisions.

Tim weighs in:

5. Have a plan, don’t dive in head first on every trade

One of the worst things you can do as a trader is to trade without a plan. You won’t know when you’re getting things right and you’ll lose track of when you’re doing things wrong. This state of confusion is what leads many rookie traders to lose money, feel disheartened and quit trading.

What Tim felt he was doing wrong before:

How Tim started to get things right:

“I am now generally going for a maximum of 3 trades in a day, but generally just one or two, which seems to be working out a lot better, not getting flurries of losses and big chunks taken out in one go. I also never have more than 2 trades that haven’t hit TP1 open at the same time. This helps to limit any periods of drawdown.”

Tim also mentioned: “I am placing my stop loss around 3-6% from my entry price, totalling about 1-2% of my trading capital.” “Generally going for 30, 30, 20, 20 [for take profit targets 1-4].”

What’s the key takeaway from Tim’s Top Tips?

From Tim’s experience we would say that sticking to a routine-driven plan for your trades helps to increase overall profitability.

This is because trading starts to make sense as you begin to see patterns of what does and doesn’t work, instead of everything being a random last-second decision.

Understanding basic technical analysis helps Tim know which signals fit his trading style best as well as which he thinks are most likely to reach their targets. So always keep learning at the forefront of mind.

Tim’s last words:

“Still got a lot to learn, hopefully in the coming months I can figure out more about how the market is behaving and how that affects my strategy, but at the moment it seems to be spells of pumps and spells of consolidation.

Also, the psychological element is massive- in the early stages every little loss had me sweating and questioning everything, now it feels like I’m not using my own money anymore, they don’t bother me at all, I just carry on with the game plan…”