Do you want to be in the top ~20% of traders who succeed? Great, you’re going to need to understand how the crypto markets work within trends and how you can take advantage of that.

Here’s what you’ll get from this article:

- Understanding ‘Trend Trading’ (Trend Following)

- How our master traders analyze the entire market in one go

- Specific, actionable example of how to turn our market analysis into profits

This is a long one, grab a drink (or something stronger) and strap in for a master class.

The ProfitFarmers Favorite Trading Style: Trend Trading

To better understand our market updates and how we produce such epicly accurate signals, you need to know what trading style our traders (and thus our algorithms) use.

At Profitfarmers, we are essentially Trend Traders. Why? Because trading the trend is the best statistical starting point in terms of nudging the odds in your favour.

Here’s a quick example with a BTCUSDT chart to show you what trend trading is all about.

(We made it as simple as possible for those who don’t know how to read charts):

Pretty straight forward, right!? That’s because for the most part it is. This logic works especially well on big volume coins like Bitcoin, Ethereum, Solana etc.

However, the probabilities decrease with low volume Alt Coins (also known as secondary altcoins or ‘shitcoins’) as they can violently move up or down without respecting the basic rules of trend trading.

In general we avoid such coins all together based on a variety of criteria.

However, during strong bull markets secondary Alt coins will generally work well and give favorable entries and trend continuations.

During such times we adapt by broadening our criteria in order to get more exposure to the markets. It is generally safe to enter secondary Alt coins during strong marketwide up trends (check out our stats for the bullrun of 2020-2021 for proof of success).

Now you understand what trend trading is, next we’ll explain how we use detailed analysis to understand the overall trend of the entire crypto market.

How Our Master Traders Analyze the Entire Market in One Go

You don’t want to sail the crypto seas without knowing which way the wind is blowing (unless you want to drown).

Here’s how we measure the weather.

Every day our Algorithms and Analysts track 9 different Assets & 18 different variables per asset to come to a general conclusion about broader market conditions.

We use about 108 Data points when analyzing general market conditions.

We analyze the following 9 Assets across 18 variables:

- BTCUSD

- ETHUSD

- ETHBTC

- BTC DOMINANCE

- TOTAL MARKETCAP

- TOTAL II

- TOTAL III

- MIDPERP

- SHITPERP

We analyze the above assets every. single. day. across 3 different timeframes to form a general view about the Macro Market conditions.

BTCUSD, ETHUSD & ETHBTC are already self explanatory, so here’s a quick summary of all the other assets in our criteria:

Bitcoin’s percentage share vs all other coins combined. If Bitcoin Dominance is surging there is a good chance that Altcoins are losing value. Similarly a drop in Bitcoin Dominance indicates that there could be decent gains for Alt coins.

A gauge of value that tracks the Total Market Capitalization of all major coins recognised by platforms like CoinMarketCap. To put it simply, the Total Market Cap is derived from all coins in circulation multiplied by current market price. This one single chart can tell you a lot about overall Market conditions and what’s likely to come.

Combined Market Value of All Assets other than Bitcoin. This chart tells us how the broader market is behaving excluding bitcoin.

Combined Market Value of All Assets other than Bitcoin and Ethereum. Basically everything in the market other than Bitcoin and Ethereum. It’s a good barometer to watch the entire Altcoin market trend in one chart.

An Index of Mid Cap Cryptocurrencies. This is a highly liquid index and is traded at FTX Exchange. It’s a good barometer to gauge what’s happening and what’s likely to come for Mid Size Cryptocurrencies.

An Index of Small Cap Cryptocurrencies. Again this is also a very liquid index and is traded at FTX Exchange. This one tells us what’s happening with small cap shit coins and what’s likely to come.

Putting It All Together

We don’t view these assets individually and instead we combine their data to come to the following conclusions:

- Market is likely to fall

- Market is likely to strongly trend on the up side

- Market will be mostly slow & sideways with chances to drop

- Market is directionless with no clear momentum

- Market is about to Bottom & Up Swing will begin

- Market is about to Breakout & big moves are coming

- Market is topping out & it’s time to sell

- Market is in the middle of nowhere & it can go either way

- Market is entering a strong bearish zone

Because of this multifaceted analysis, we can generally keep up with the pace of the markets and adjust and adapt based on the market conditions.

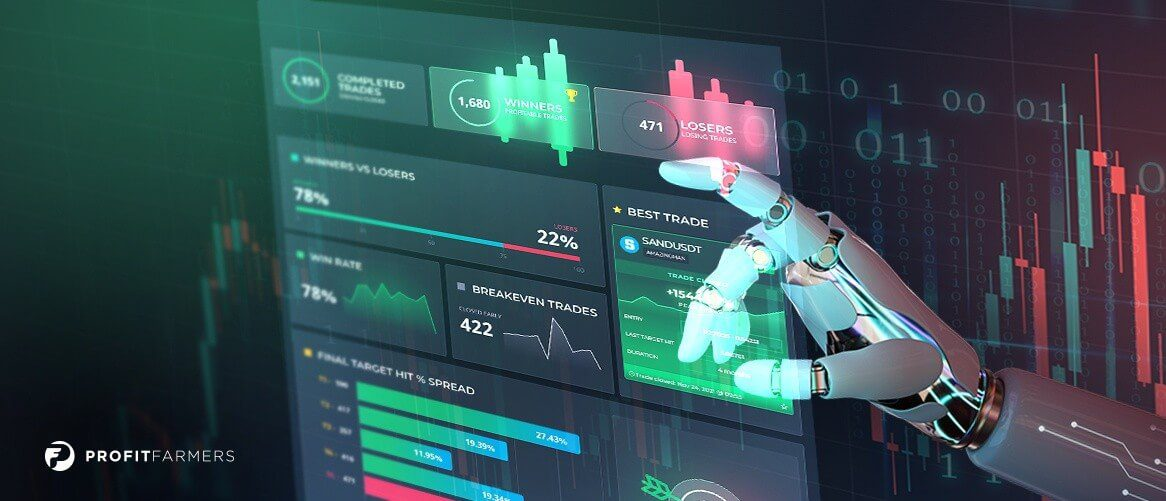

Statistically, we get it right 8 out of 10 times and, therefore, our win rate is consistently above 70-80%.

Understand that no trader/trade idea on planet earth will get it right 100% of the time (If you find one that does, it’s most likely a scam).

Where does ‘Trend Trading’ fit in to this? Well in simple terms, when there is a major shift in the overall market direction you can expect trends to start or end. Swing traders love these moments (more on that another time).

There are also times when market conditions change abruptly due to unexpected events that affect the world.

for example:

- Covid 19

- New Strain of Covid

- China banning Bitcoin

- SEC prosecuting Ripple

- China invading Taiwan

These types of events cannot be predicted in advance and the market’s reaction to such events always results in abrupt and random price action.

When events like this happen we issue warnings to reduce exposure and book profits on the next bounce or relief rallies.

Now you know how we create our market updates, let’s take a deep dive into how you can turn this knowledge into cold, hard cash.

How to Use Market Updates and Analysis to Make Profitable Trades

Grab a 2nd cup of coffee because we are about to go nitty gritty on the details. Seriously, it’s about to get dense, but nothing worthwhile is ever easy!

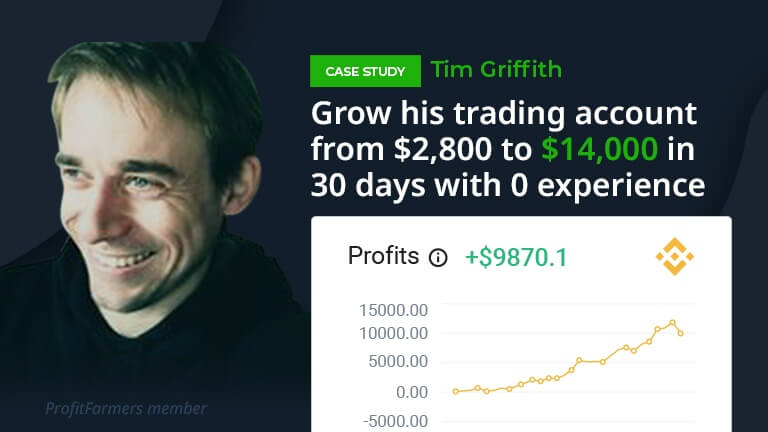

Using the PF Market Update “Bitcoin Breakout 55k coming?!” To Make a Winning Trade

Let’s use this Market update from March 29, 2022 as our example.

Here’s a summary of that Market update:

- Bitcoin has broken out of the yearly open

- Bitcoin finds resistance at 48k

- Possibility of Bitcoin breaking out of 55k

- Be careful if bitcoin falls below 42k support level (sit out of the markets or go short)

This was the Bitcoin chart at the time when this market update was released.

If Bitcoin fails its breakout, we said there are 2 options you can take:

1. Sit on the sidelines, or

2. Take up a short position as it is highly likely that Bitcoin will dump further.

So How Could You Take Action Based on That Market Update?

FIRST STEP: Understand what was said in the Market update

Listen clearly to what we say in the market updates. In the example, we said that Bitcoin could do a few things depending on price action.

So the first thing to do is to… wait. Wait and watch what Bitcoin does. Many people don’t like this, but patience plays a huge part in trading. Waiting might be boring, but it is integral to being profitable in the long run.

Think about it. If you see this juicy green candle being printed, if you don’t understand technical analysis you would have FOMO’d in and lost all your money.

Sure enough, after a week of waiting, we have our confirmation. Instead of breaking up, the price falls below 42k USD (failed breakout).

Now that Bitcoin’s price action confirms our theory, what should you do?

SECOND STEP: Take action

Depending on your risk tolerance, you can do the following:

a.) Reallocate your funds accordingly. Transfer all funds to stablecoins, exit all long positions and wait for further price action to play itself out or until we say that longs are viable again. (remember that Bitcoin influences the altcoin market heavily)

b.) Create a short order by using Binance.com

Here’s how you can go short next time you want to profit from other people’s misery.

Making a Short

You’ve seen the price action, and now you’re feeling like Christian Bale in the movie Big Short. Here’s how to short Bitcoin based on our market analysis.

- Plan your trade

- Execute your plan

First things first. Plan your trade. Use Technical analysis to identify your entry price, take profits, and stoploss

Technical Analysis (TA)

It’s important that you use Technical Analysis to find your entries – you DON’T want to enter a trade blindly. For this example, we’ll use the Reverse Moving Average strategy that we’ve shared here.

If the following information is hard to understand, make sure you watch the video linked just above!

Here’s the gist of that strategy:

- Wait until the 13 EMA is below the 21 EMA, the 21 EMA below the 200 EMA. In the example below it is as follows:

- 13 EMA = white line

- 21 EMA = yellow line

- 200 EMA = blue line

- Make sure Exponential Moving Averages are expanded to confirm the trend

- Place limit sell orders on the 200 EMA. There are 2 ways you can approach this:

- Market buy as soon as you see the 200 EMA being tested

- Wait until the ‘breakdown’ candle closes below the 200 EMA before entering

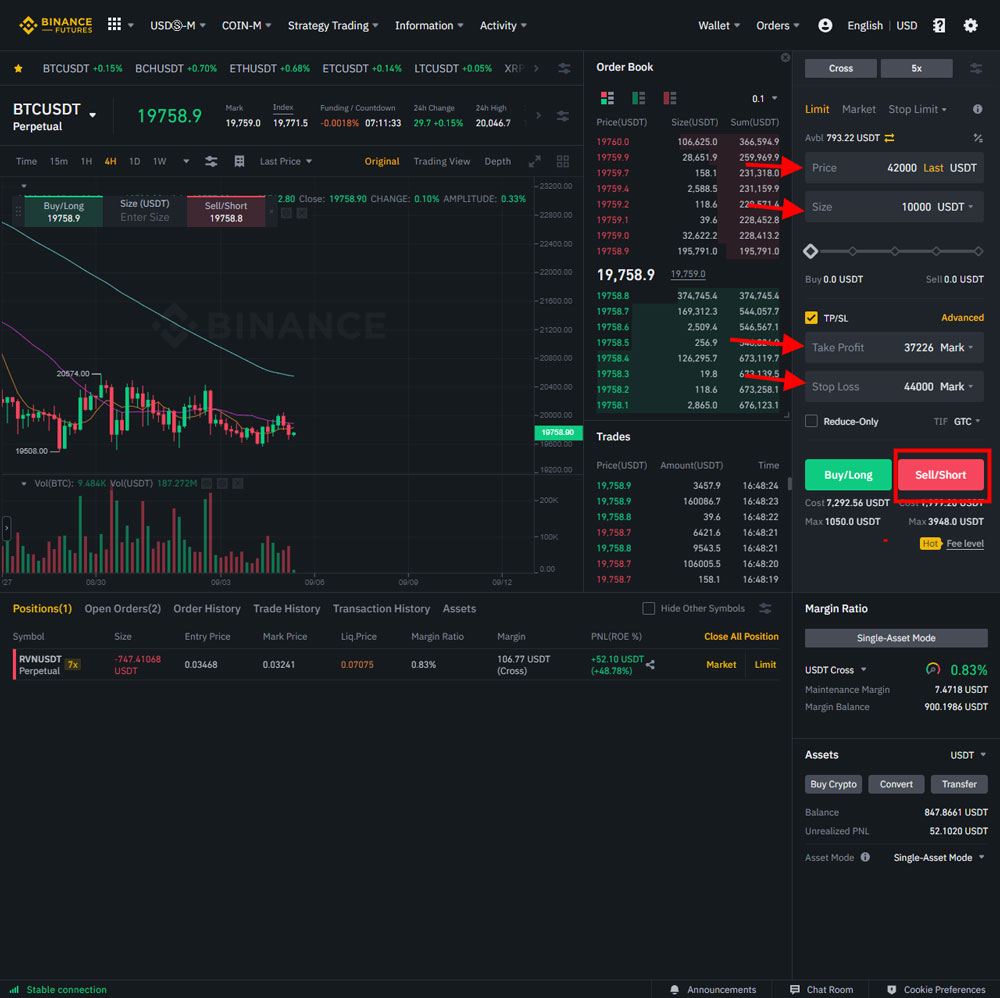

Based on the Technical Analysis using this EMA strategy, there is a good entry for a short at $42,000.

Risk management

Now that you’ve done TA to identify your entry, it’s time to do some risk management.

This is the part where you identify your stop loss using technical analysis.

For this example, you will place a stop loss above the 200 EMA and above the newly formed resistance level of $42k… around the $44k price point.

This is so that your Stoploss isn’t too tight and gives the price some space to move around.

The stop loss ensures that if the price hits $44k you are OUT of the trade. You do not want to incur more losses should the price breach that level.

Knowing where to place your stop loss is only the first half of risk management.

The second half is knowing your risk profile.

To know your risk profile, you need to figure out what your proper trading size is based on your total trading balance. (Oversizing your positions can lead to a world of hurt and regrets)

Use the following formula to calculate your trading size: Total trading balance x Your Risk % / Invalidation %

Now that you have all your variables, use the formula we gave you to get your trading size:

(Trading balance)10,000 x (Risk%) 0.05 / (Invalidation%) 0.05 = $10,000 trade size

That means you can enter this trade with a $10,000 trading size, and if the trade should go against you, you will lose ONLY 5% of your $10,000 total account size ($500).

Risk Reward Ratio (RR)

Now you’ve finished planning your entry and your stop loss. The next step in planning is to decide how much money you want to make.

To this extent, you need to figure out your Risk to Reward ratio. The risk to reward ratio measures the difference between a trade’s entry point to a stop-loss and take-profit orders.

There are many benefits of planning out your RR ratio, but one standout benefit is you will gain more confidence in your trade. If you see you can make twice as much as you will lose when you make a trade, this will increase your overall confidence when taking a trade. (It is extremely important to develop your confidence as a trader, but that’s a whole nother article in itself.)

The first thing to do in planning your RR ratio is to identify your take profit targets. Usually, previous support levels in Bitcoin’s (or any coin’s) price is a good place to start finding take profit targets (TP).

above are the key support levels represented by the white horizontal lines.

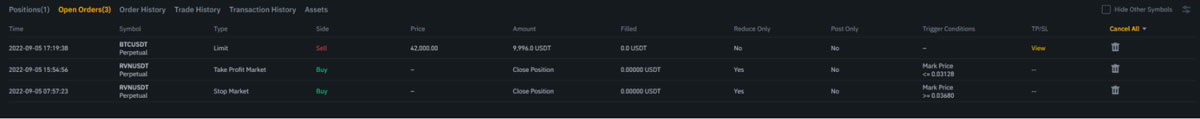

- TP 1 at $37,226

- TP 2 at 34,253

- TP 3 at 29,054

- TP 4 at 19,850

This is what the RR ratio looks like per take profit level calculating from the 42k entry price:

- 2.3 RR ratio at TP 1

- 3.7 RR ratio at TP 2

- 6 RR ratio at TP 3

- 10.6 RR ratio at TP 4

If the trade goes in your favor and hits a target, at TP 1 you will make 2.3x more than what you will lose. This means that you stand to gain $1150 by risking $500.

Think of it as paying $500 for the opportunity to make a profit of $1150.

The same logic applies to the other targets.

At TP 2 you stand to gain $1,850

At TP 3 you stand to gain $3,000

At TP 4 you stand to gain $5,300

To keep things simple, in our example you aimed for Target 1, as a 2.3 RR ratio is a decent enough trading plan.

- Execute your plan

The Bitcoin short trading plan

Entry: $42,000

Stoploss: $44,000

Take Profit: $37,226

RR ratio: 2.3

Now that you’ve done your planning, it’s time to execute. The best place to create short orders is inside your Binance futures trading terminal.

- Go to Binance.com

- Open your Futures trading terminal (you can find it under derivatives, then select USD-M)

- Input your trading plan into the Binance trading form on the right side of your terminal.

- After inputting your trade plan, click on the sell/short order to execute your trading plan

- Click on open orders to confirm your order is there.

- Sit and wait.

Luckily the trade goes in your favor and hits take profit 1

In fact, bitcoin fell all the way to 17k after our call in the market update, meaning even target 4 in this trade idea would have been hit!

Conclusion

As you can see we are covering the Crypto Markets from a 360 degree perspective & in general we will be able to catch most major trends.

We are confident that we will win more often than not. However, Black Swan Events (abrupt trend changes) may result in stop losses being triggered or a large amount of close early trades.

Overall we try to keep things simple so some of our updates may be short and sweet – but you can always refer to this guide and check out the charts we’ve listed for yourself to get a wider perspective.

Try not to think in absolutes of all in or all out, do not be afraid to just go flat and stay out of trades any time there is a word of caution in the air. Missing some trades is better than losing capital. We cannot stress this enough.

Final Words: Trading & Investing is a game of survival. We need to survive in order to consistently grow capital. In order to survive, we need to deploy prudent risk management practices.

We need to maximize the gains during safe periods when the market is strongly trending and safeguard capital by reducing exposure during choppy periods.

Remember to think long term, planning your trades before making them is one huge step towards the right direction. If you want a step by step guide on how to do that, continue your education by checking our blog How to be a Long Term Profitable Trader – Risk Management, Risk:Reward Profile and Automations.

This Market will continue to pump for the next few years so you will have plenty of opportunities to grow your capital.