Want the quick and dirty on the rising wedge pattern and how to play it?

Watch this video where Matthew covers the basics:

The Rising Wedge is a technical trading pattern that traders can utilize to look for either the continuation of a bear trend or the potential exhaustion and reversal of a bull trend.

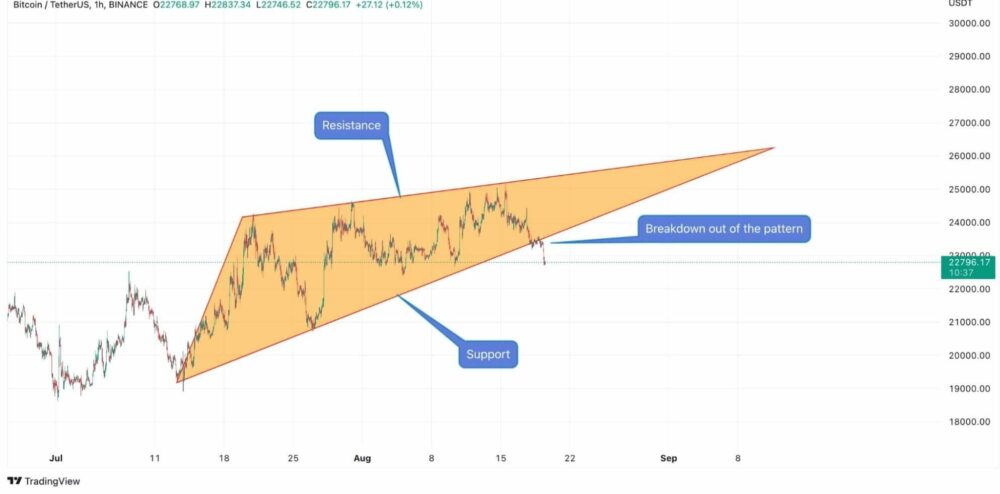

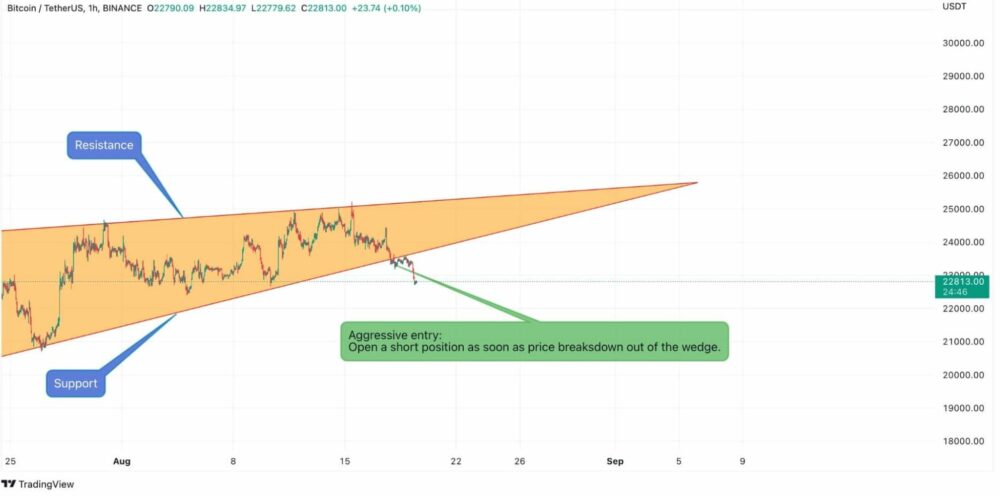

In the image above, we can clearly see how the Rising Wedge looks amongst price action. You will see two upward sloping trendlines: the bottom one is considered Support and will have at least two touches from price action to be able to draw the line; the top trendline will be considered Resistance and will also have two points that the trader can use to draw the line.

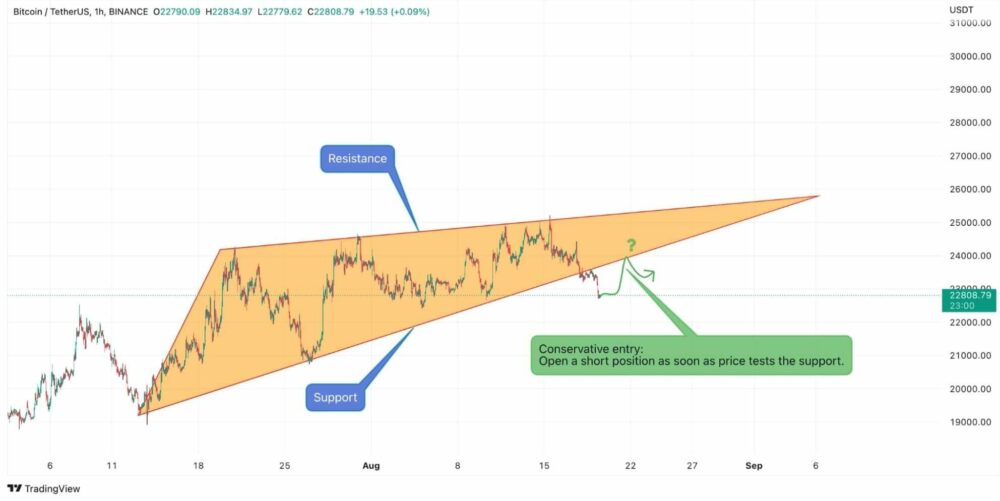

We can clearly see the Support and Resistance lines if we create “zones” instead of a simple trendline, as seen in the image below.

Traders will look for a break in the Support line as a signal that the Rising Wedge is a legitimate pattern and not a false signal. This break helps to confirm the bias of the pattern, which is that downside is coming to the asset.

Trading the initial break is only for aggressive traders as not all breaks will be confirmed. The more conservative traders will look for a retest of the broken Support line.

In the image below, we can see the break of the Support line with a very strong downward candle, and we can also see the retest of the Support level only a few candles later.

One great thing about pattern trading is that, more often than not, price targets, entries, and sometimes even stop-losses are already figured out for the trader based on the rules of the pattern.

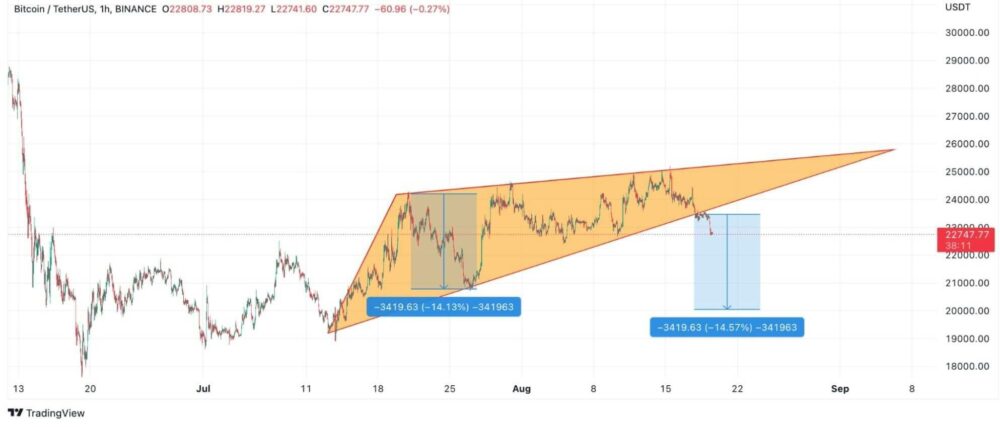

In the case of a Rising Wedge, traders will utilize the initial high and the following low as the ‘Measured Move’ for their price targets.

Below, we can measure from the initial high and following low and copy/paste them to the area when the Support level was broken. Notice how the percentages are different, but the price decrease is exactly the same.

Only ever measure the price differential and use that as your Measured Move, not the percentage dropped.

As mentioned before, an aggressive trader would already be short of the asset once the level was crossed. Some less aggressive traders will at least wait for the candle to close and maybe wait for another candle or two as confirmation before shorting the asset. Neither is right nor wrong.

Conservative traders, however, will wait for a retest of the broken Support level. The risk here is that the retest may never come, and the trade is over. Whichever way you choose, the target level remains the same.

The conservative traders will have their patience pay off for them as they will get a better entry and therefore enjoy deeper profits.

In conclusion, the Rising Wedge is a potentially bearish pattern. When found in a downtrend, it can point to a continuation of that trend and could also be part of a larger pattern called a Bear Flag.

When found in an uptrend, the Rising Wedge can help traders identify that a top may be in and the asset is ready to cool off for a bit. This pattern can be coupled with other indicators, especially ones that deal with Volume or Momentum.

Volume is often tied to the pattern, as traders will look for a decrease in volume while the price is ascending. This divergence helps traders determine if the current uptrend (in the pattern) is weak or not.

BTC Current Price Action

Luckily we have a trading opportunity appearing before us with Bitcoin’s recent price action (as of August 19, 2022).

This is the rising wedge pattern forming on BTCUSDT. As you can see, there is a breakdown out of the pattern which gives us an opportunity to go short.

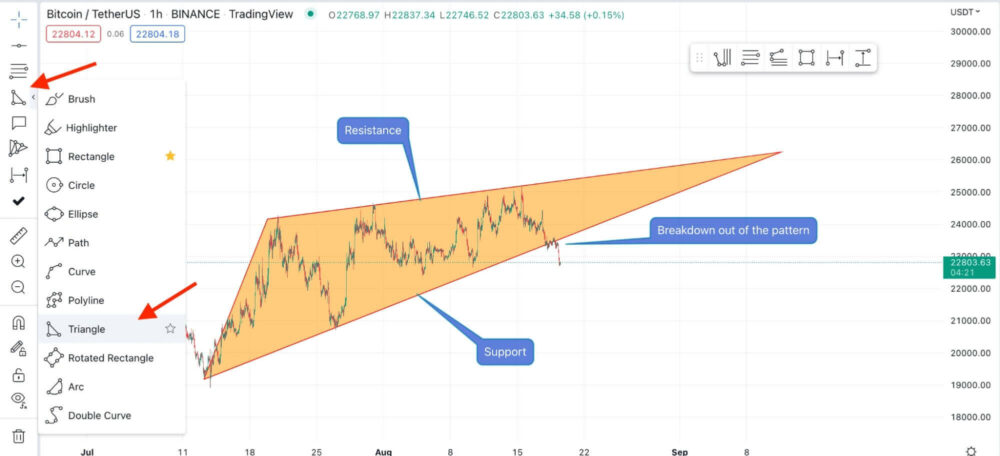

Tip: To easily draw the rising wedge pattern onto your tradingview charts, use the triangle tool which you can find here, shown in the image below

Trading using the Rising Wedge Pattern

Entry:

As we’ve said above, there are two ways you can trade this pattern.

1. Aggressive trading style – enter as soon as the price breaks down of the wedge.

2. Conservative trading style – Wait for a retest of the support before entering.

Stop Loss:

There are many ways to identify your stop loss, what is important is that you have practiced proper risk management to prevent you from getting stressed out about your trade.

(If you don’t know how to do risk management, PLEASE check out our article here)

Exit (Take Profit):

Measure from the initial high and following low and copy/paste them to the area where the Support level was broken.

Tip: On tradingview, use the price range tool to measure from the initial high to the following low so you can copy and paste the measurement.

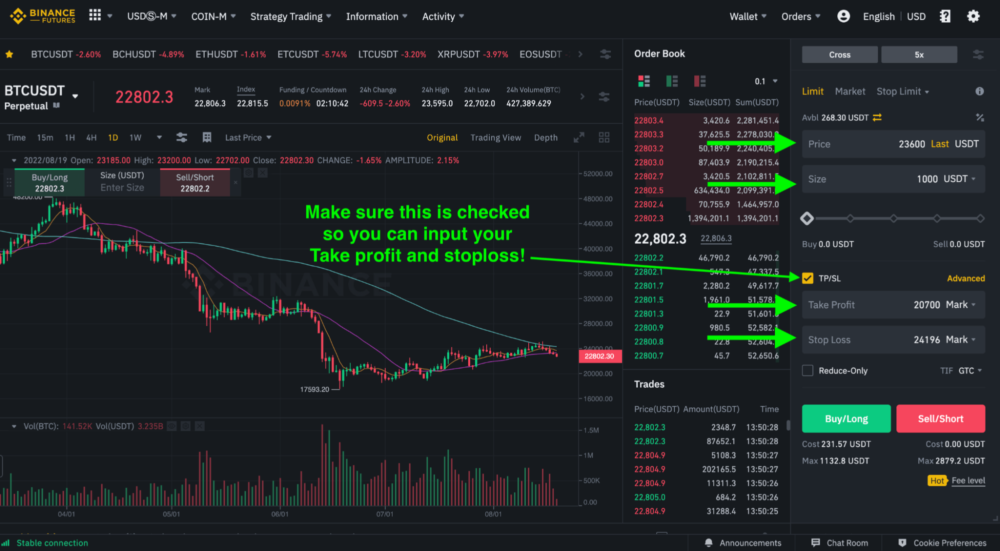

Executing the trade inside Binance.com

We will now make an example of how you can short trade with this strategy inside binance.com

Example

After doing Technical analysis, you’ve successfully identified your entry, take profit target, and stoploss.

Here are an example of a trading plan:

Entry price: $23,600

Stoploss: $24,196

Take Profit: $20,700

Trading notes:

- Will wait for Rising wedge support to be tested.

- Conservative approach by using a limit sell order.

- When this trade goes against me, I will only lose 2% of my total account

- Great risk reward ratio of 1:4

How to do it inside Binance.com

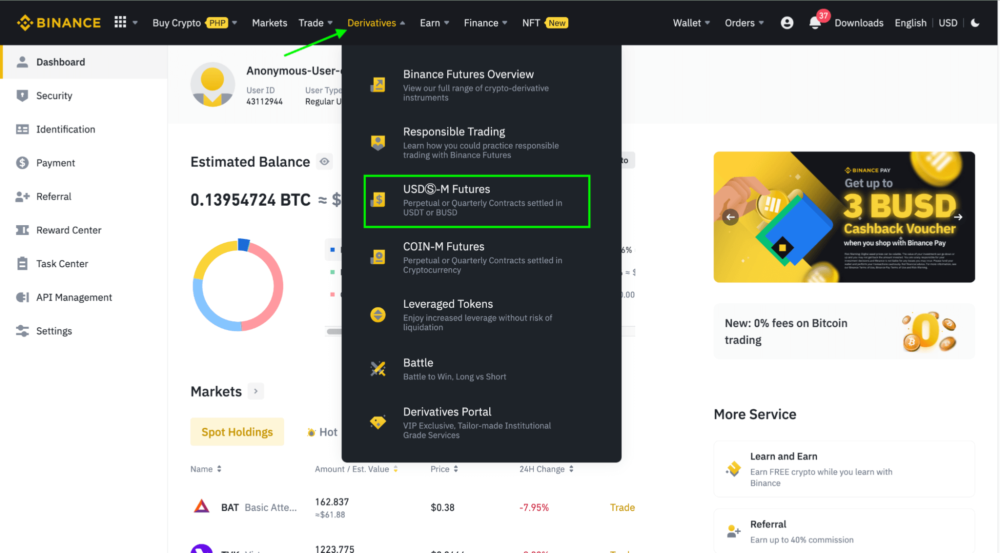

1. To make short orders, do it inside your Binance Futures account (you can access it via derivatives in the Binance homepage).

2. Go to the order form which you will find on the right hand side of your trading terminal.

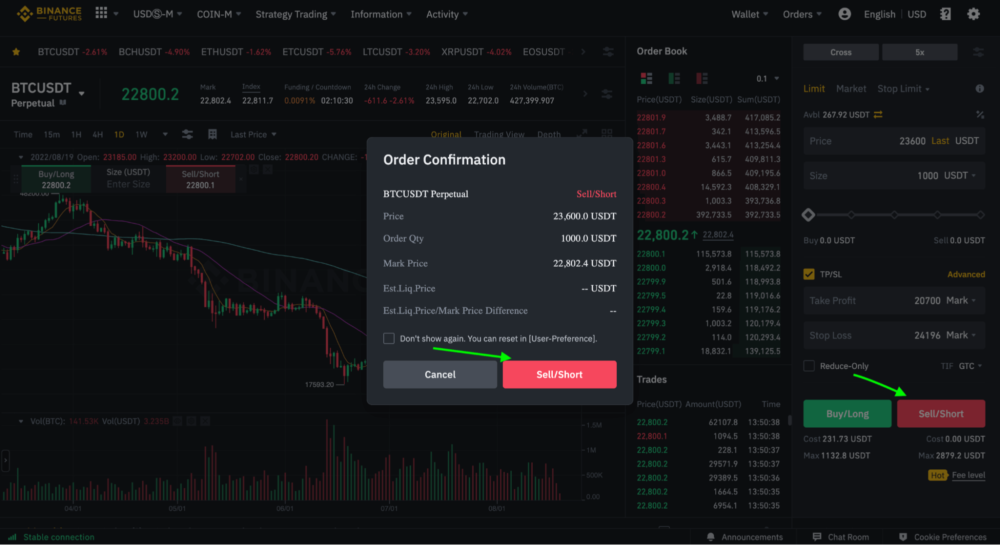

3. Input your trading plan accordingly.

4. Click the Sell/Short button.

5. Double check inside your open orders tab to see if the trade was successfully created.

That’s it, you successfully went short! Obviously there are other ways to get short by using market orders and then adding your take profit and stop loss afterwards. Do whatever feels right for you!

If you missed the breakdown of this wedge, don’t panic! There are always more trades just around the corner. Make sure you’ve understood how to play wedges for the next time one shows up.