Do you want to know how to catch HUGE price moves before they happen?

If you know what other traders/investors (especially whales) are trading, you can predict which cryptos are likely to make big moves.

Volume is the easiest and most reliable way to identify these opportunities. It’s also one of the most overlooked Technical Analysis tools available, despite being one of the most effective indicators in existence.

Feeling pumped about volume yet!?

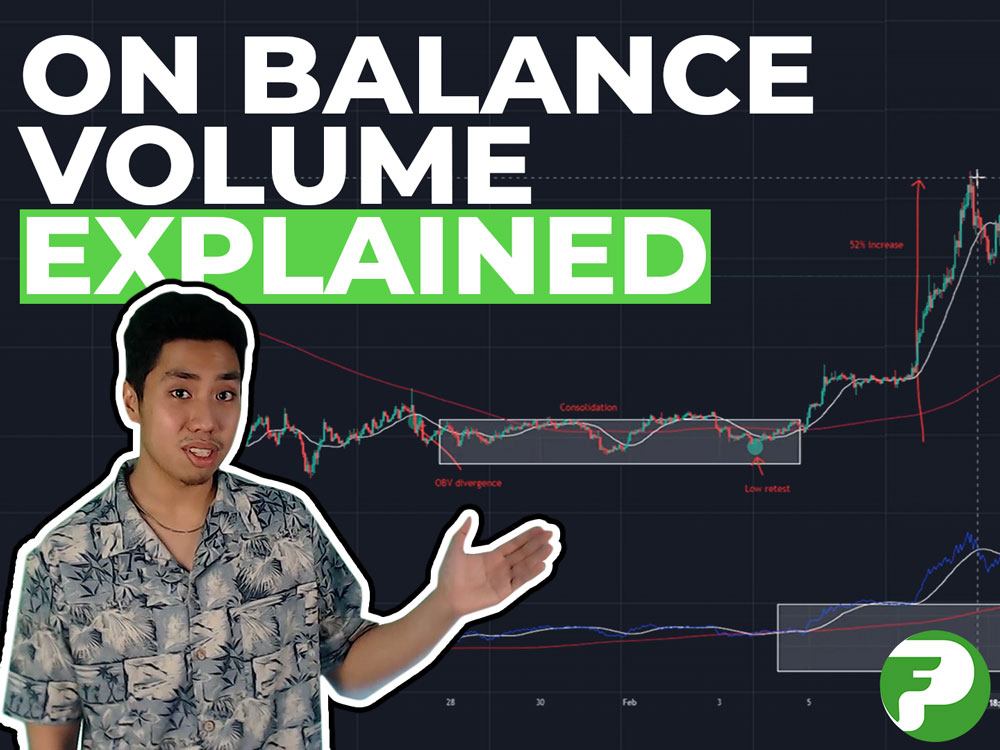

Watch the video below to understand this easy to use, high win rate strategy that can help you improve trading results!

If you prefer to read all about it, then carry on below!

The trading strategy explained uses the On Balance Volume Indicator or OBV.

Essentially, the OBV uses volume flow to predict changes in price. You can use the OBV and some Moving Averages (MA’s) to find divergences between volume and price. Once you can find these divergences, a price reversal will likely happen.

To appreciate price reversals, here’s a simple equation:

Open the correct position before price reversals = MASSIVE GAINS (duh!)

How to add the OBV and MAs to your charts:

Step 1: Go to tradingview, click the indicators tab and look for OBV

Step 2: Add the 20 & 200 MA on top of the OBV indicator

To do that, hover on the OBV name and click ‘more’. Now click add indicator to OBV. Look for MA and add 2 of those. Change inputs (length) to 20 and 200.

Note: Tradingview has an indicator limit for lower subscription plans, so if you don’t have a pro plan look for ‘20-50-200-SMA’ (use the 20 & 200 MA only)

Step 3: Click on the indicators tab again and add the 20 & 200 MA’s to your price chart

Time frames

Watch the 1 hour chart for short term reversals and daily for mid – long term reversals

Logic

This strategy uses a very nice and simple logic: After a dump or pump, if volume increases without an accompanying move in the crypto’s price expect a reversal in price.

- Works best after a pump and dump

- Reliable time frames are 1 hour for short term, daily for mid-long term

- Make sure there is a divergence with the OBV and actual price, and the MA’s are giving confluence

- If you are a bit savvy place your entries where there is support to catch that retest

- You can play it safer and waiting for price to reclaim the 20 MA & 200 MA before entering if OBV is still using the 20 MAs as support since the divergence

Hope you have fun and book those profits with this strategy!

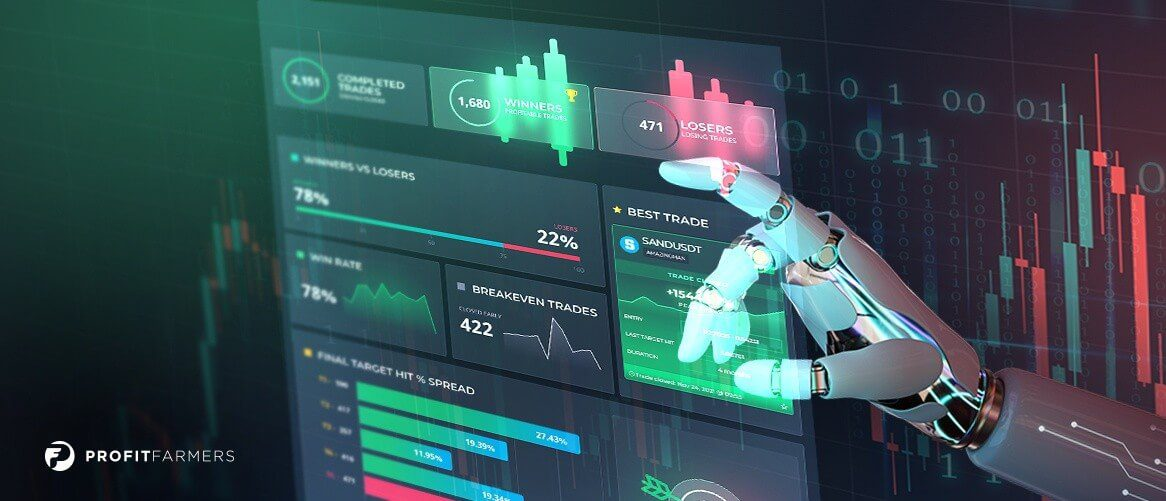

Get access to awesome strategies like this by following our Trading Signals. End the struggle and make trading easier for you.

Subscribe now to get access to high quality tools like:

- Copy-trading

- Laddering Mode

- Trade Guardian (Automatically exit trades that deviate from the plan)

- Breakeven stop loss

(Automatically exit trades that deviate from the plan)

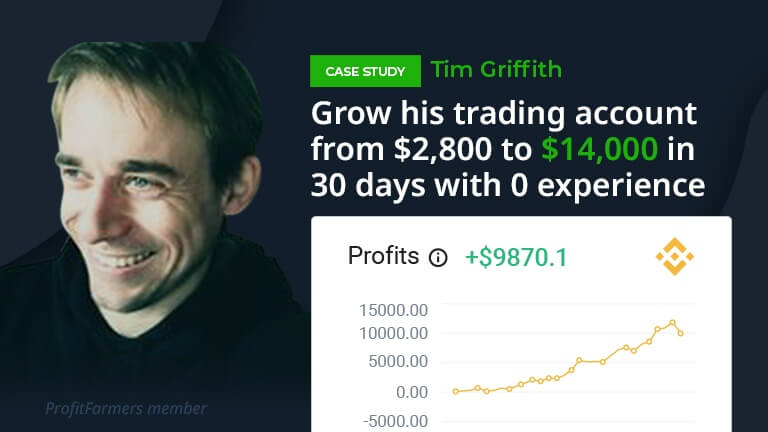

Just check out how it went for these guys!