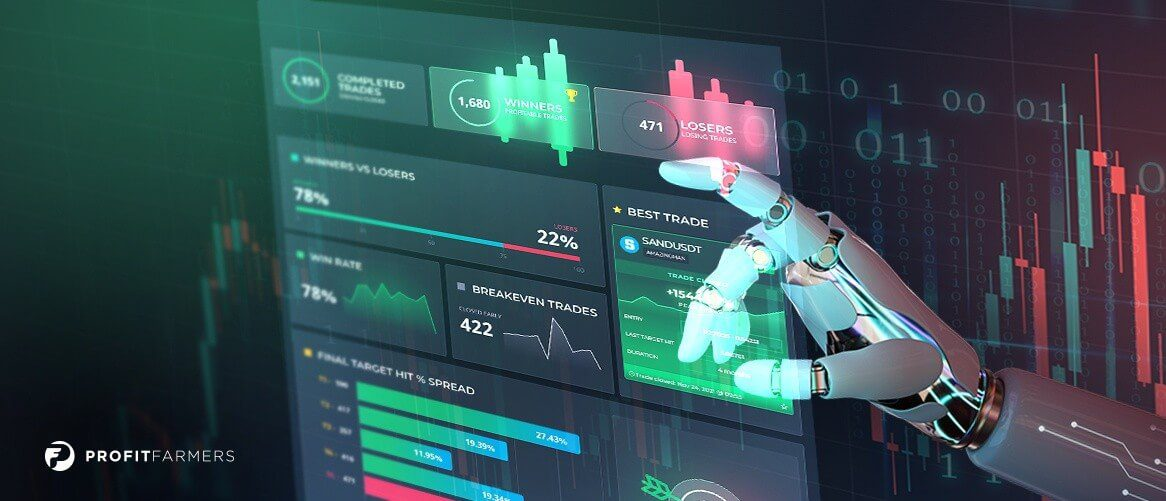

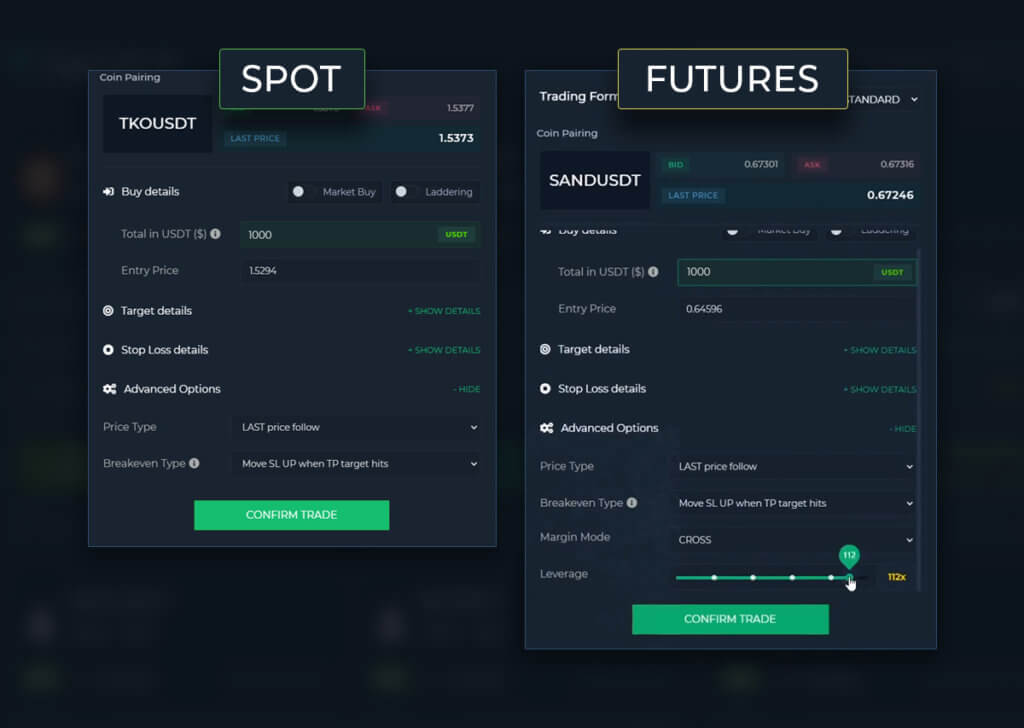

ProfitFarmers often produces 100’s of Binance trading signals every month for both SPOT markets and FUTURES markets.

If you’ve been avoiding the Futures signals out of fear or confusion then you will have missed out on some huge gains!

If you are already a member, Matthew is here with a quick video to explain why you don’t need to worry, copy-trade our Futures signals just like you do with Spot:

What are ‘Futures’?

Let’s start with the basics. Futures trading is different from Spot trading in a couple of fundamental ways:

- When trading Spot you actually buy and sell the coin/asset in question. With Futures you are simply trading the price of the asset up or down.

- Due to the above, when you trade Futures you can go Long (buy) or Short (sell) and make money in either direction.

This means that trading Futures opens up an entirely new world of opportunities as you can make money as the market goes down!

As you don’t own the coins that you trade when using Futures contracts, your trades are handled as ‘positions’. A position can be negative (short), positive (long) or neutral (no open trade).

If you copy-trade a Binance Futures signal that suggests that you buy (or go long) this will open up a long position inside your Binance Futures account. When the system detects that it is time to take profit or exit your trade it will reduce or close your position.

So in short, Futures trading works almost identically to the spot trades that you are already making via the ProfitFarmers dashboard.

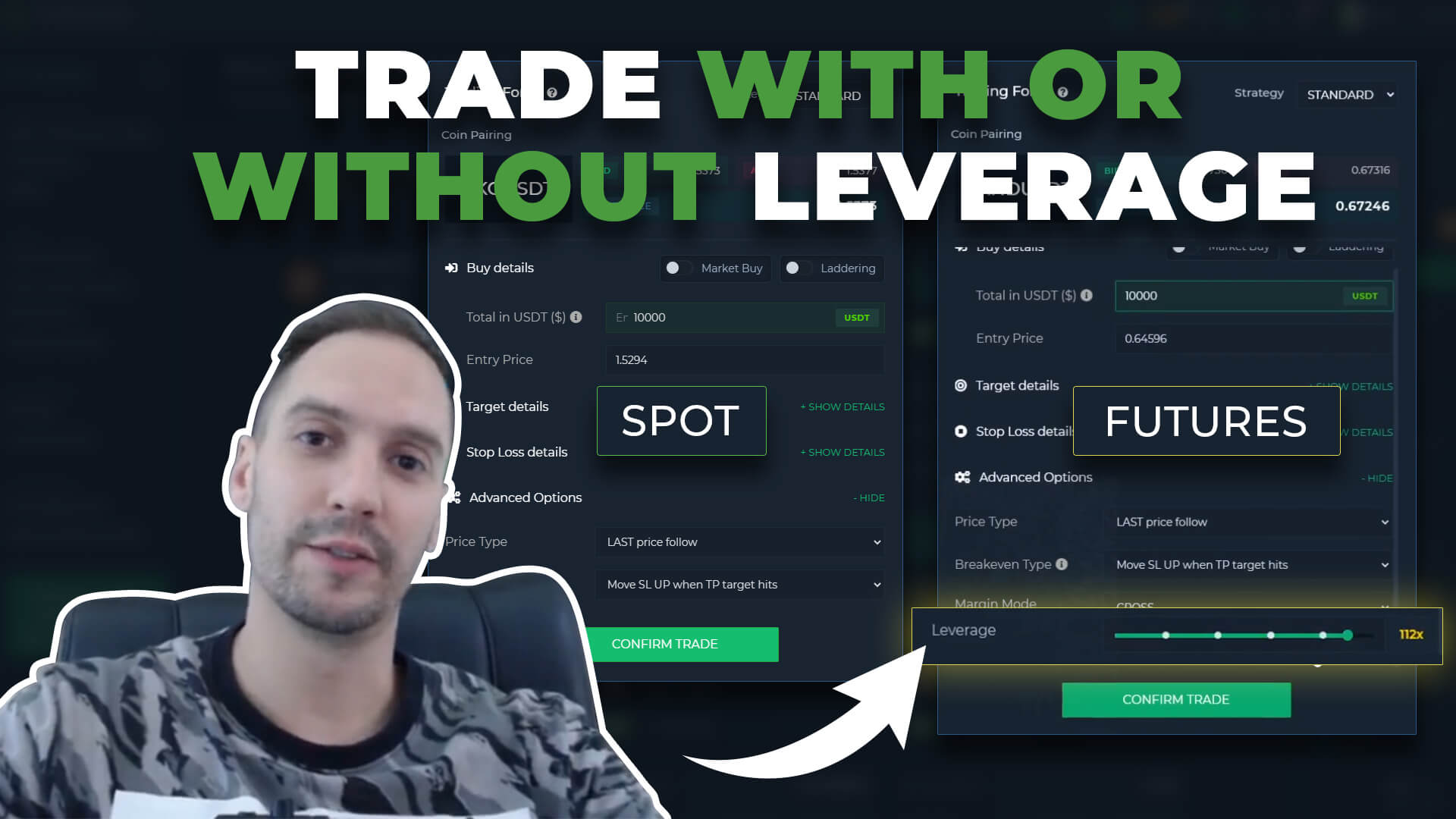

What about leverage?

Important – You do not have to use leverage when copy trading our Binance Futures signals.

The ProfitFarmers system will typically suggest a leverage multiplier that you could use when trading a Futures signal, 10x for example.

Many of you will have already heard the horror stories of over leveraging and blowing up your account (liquidation, REKD, etc) but there is no need to panic. Leverage is a choice and the system will not automatically increase your trade size.

The typical misunderstanding

Setting a high leverage multiple on the trade form itself does not increase your trading risk. The leverage multiplier simply enables you to place a higher volume trade than your account would normally allow.

So in that sense, if you set up a trade on 1x or 100x for a volume of $1000 worth of X coin, a 10% drop in price will still mean a loss of $100.

If you usually input $1000 into the trade quantity for a Spot trade, you can enter $1000 into a Futures trade and have no additional risks regardless of what leverage multiple you have assigned as long as your Futures account size is actually >$1000.

Where the risk actually lies

Where the damage is being done typically is if you are using leverage to make that $1000 trade, your account size could be just $100 itself. Using leverage allows that $100 to become a $1000 ‘bet’ (10x)

That means if your $1000 trade loses 10% or $100, you actually just lost your entire account size and are liquidated (because your account was $100 in the first place). But if the trade goes up 10% then you actually just doubled your account size to $200.

This even means that people using very high leverage have to consider that their liquidation price within Binance may be closer to their entry price than their desired stop loss.

In simple terms

Leverage won’t hurt you as long as you consider the $value losses you will incur at stop loss. The trade form will ask you for a simple total USDT value of X coin you want to long and your stop loss $ would be that total multiplied by stop loss -%.

If you don’t trade with more money than you actually have in your account then you are not leveraging at all no matter what multiple you choose.

How can I trade Binance Futures?

Trading Binance Futures signals with ProfitFarmers couldn’t be more simple:

- Navigate to USDT Futures within your Binance account and open up a Futures wallet (you may need to complete a short quiz)

- Create a new API key and ensure that you tick ‘enable futures trading’

- Connect this API key with the ProfitFarmers system in your settings

- Done! Go ahead and copy any signals you like the look of

If you need help there are articles in the knowledge base or you can reach out to support!

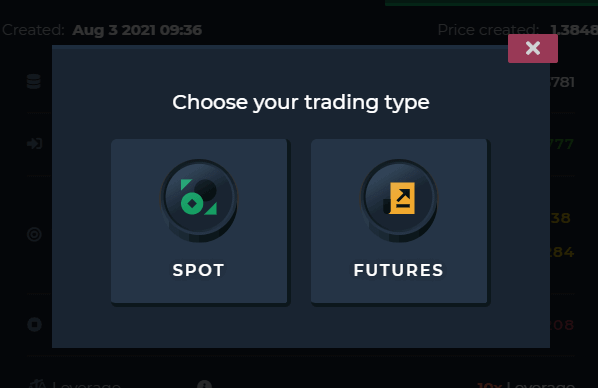

You can now trade Futures Signals with Spot!

This feature was also introduced partly In response to the sudden Binance announcement where futures trading in some countries* was disallowed. If you were one of those affected by this, just click on Spot whenever you trade our Future signals and you can go on to trade the signal as usual.

What to consider when choosing:

Normally, there should be no issue when trading Futures signals with Spot, as the charts usually mirror each other 99% of the time. However there is that 1% chance where the charts will not match, and this might cause an issue with notification.

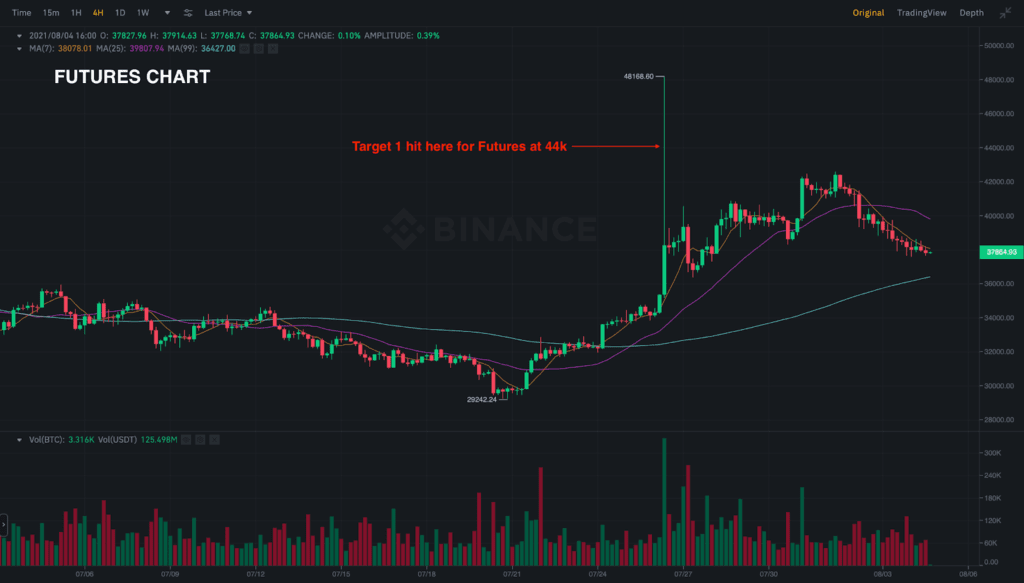

Consider these two screenshots of a BTC Spot chart and BTC Futures chart.

FUTURES CHART:

SPOT CHART:

As you can see in the Futures chart, Target 1 was hit but not in the Spot chart.

When you enter a Futures signal and trade it as Spot, the same scenario has a possibility of happening and you will find that in the dashboard it will display that the signal has already hit T1 (because in the dashboard it is a futures trade), but when you check on your account none of your coins have sold.

There is no way around this except to just deal with it. This is only a minor inconvenience and will not have any drastic effect on your trades.

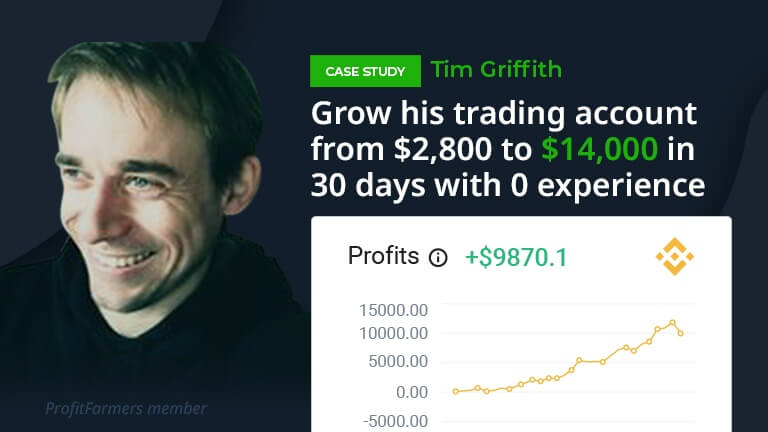

Now you don’t need to miss out on winners like these...