Should I trade during choppy, bearish markets?

Great question my friend, gold star for you.

Short answer: If you have some technical analysis skills then yes. But you have to be much more strict with your risk management and have the ability to know when to cut a trade early.

If you are trading using the ProfitFarmers platform this isn’t an issue, our Trade Guardian feature can automatically exit trades that are looking weak and wandering off course even whilst you sleep but that’s only half the battle, let’s continue…

You’ll have a serious edge over the average trader if you can understand the following:

Knowing WHEN to trade is more important than WHAT to trade

Why? Probabilities and Emotions.

Some traders are soulless Borg-like beings.

Boredom? – “Never heard of it”

Euphoria? – “Is that a band?”

Frustration? – “I’ve had blue balls for decades”

These are the people who stick to a plan, only play when the odds are in their favor and feel nothing when wins and losses come in. It’s all just part of the show. You will trade. Resistance is futile.

They can trade (or not) anytime anywhere – it’s all within a defined and well understood plan.

But let’s talk about normal humans.

Bearish or choppy markets are HELL. Trading becomes more intensive, boring and frustrating even for the best traders.

Trends fail to continue and ‘false breakouts’ happen more often than ‘breakout breakouts’.

Traps are everywhere.

This means we have to react quickly and close a lot of trades early from time to time. Stop. Start. Stop. Start. Stop. Start. Even reading that is annoying, now try trading like that.

Trades that close early can turn into minor losses here and there. Newer traders aren’t used to the sensation of ‘bleeding out’, a term used for when your trading account size is slowly decreasing. The truth though is that it’s all part of being a long term profitable trader.

This is usually when novices start to panic. Then, they tend to make things worse by chasing losses or get mad that things aren’t working as expected.

The plan goes out of the window and their trading balance follows with it soon after.

So should I trade? Give me a solution!

We often produce trading signals even during choppy markets because we are catering to a mixed ability trading community, including high level, dedicated trading professionals.

If your pronouns aren’t Borg/Us, we have 2 solutions in mind:

1. Stop trading during bearish, choppy markets

Option 1 is best for people with less self control, less experience and anyone that can’t understand that closing trades early for small losses (bleeding) is part of the bigger picture.

“No trade is sometimes the best trade”

Trading is the ultimate game of patience and is highly rewarding in the long run. Avoid the bad months, keep your trading balance ready for the good months. It’s that simple once you take a long term view.

You never know when the next breakout will be though, which is why we recommend having a long term ProfitFarmers subscription.

A lower price means you’re not going to pressure yourself into trading during the roughest times.

Why do you think people take our lifetime membership plans? You pay once and never pay again. Instead of pressuring yourself to trade S*** markets because your subscription is running out, you trade only when it’s optimal.

The lifetime membership could pay for itself within a matter of months simply because you’ll trade smarter and avoid unnecessary losses.

2. Toughen up mentally and adapt your trading game to the current conditions

At the start of this article we mentioned that ‘trading the chop’ requires you to have discipline and the ability to know when to cut a trade early.

Thankfully, our trading algorithms automatically identify trades that are looking weak and will recommend you pull the plug early.

Our Trade Guardian feature takes it a step further by offering to automatically close those trades so that you can actually sleep, go to work, or assimilate each distinctive species in the galaxy into your collective – you Borg b*stards! Oh, wait you aren’t the Borg…OK, go whatever it is you do in your non-borg life.

Discipline, risk management and awareness is on you. We aren’t going to spank you when you f*ck up (no matter how much you pay us, sorry).

Actionable Tips for Trading During Sideways or Bearish Markets

Before we go on, remember, NOT TRADING is super smart a lot of the time! If you have a long term mindset you don’t need to be an amazing trader.

Still want to learn to trade in bad weather?

Prepare to be assimilated into the trading hive-mind with these top tips:

Combine Laddering Mode with Trade Guardian to Minimize Losses

If you check our yearly or monthly statistical reports you’ll find that on average, our completed winning signals tend to dip around 30%-40% into the entry zone.

This changes month to month and will depend on the current market conditions so focus your attention on more recent result reports and check our market analysis for further details (more on that tip below).

If you activate laddering mode, by default the system will divide the entry zone into 5 equal slices and will aim to buy 20% of your total trade size at each level which gives you a couple of benefits:

- You will get a decent average entry price vs entering at 1 higher position (avoid FOMOing in)

- If the trade closes early you take a loss based on your lower average price and a partial trade size

Combining this with the Trade Guardian feature means that your average entry price is solid, the system will sound the alarm when a trade seems to be failing and will automatically exit for you so that you don’t need to watch the charts. Nice!

Here’s a quick video where Carlo covers this concept in a bit more detail:

Don’t Make Entries too Aggressively

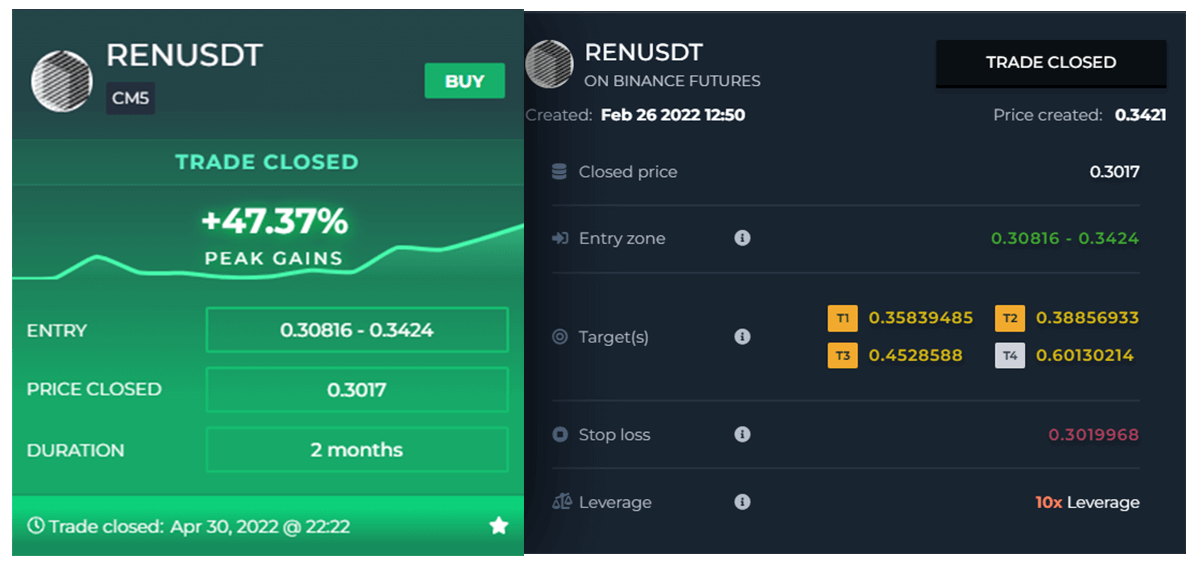

Here’s a signal from late Feb 2022 that popped up for RENUSDT on the CM5 strategy.

We see that trades often close early around the middle of the entry zone and that has left some people thinking that going aggressive (buying heavily at the top of the entry zone) is the best way to catch winners.

In reality though, this is not always the case as it entirely depends on the price action and other factors that we are monitoring. Take a look at the RENUSDT chart:

This was a fun trade but the most important thing to take note of is that the price dropped all the way down to just below the bottom of the entry zone.

Stop loss was avoided and then the price exploded out hitting a couple of targets rapidly. Trade Guardian never activated.

There are tons of examples like this but 1 is enough to point out that you shouldn’t ‘assume’ winning trades can only come from the top of the entry or that all trades will close early if the prices dips under the mid-range of the entry box.

Taking balanced approaches or even defensive (where you buy more heavily at the bottom of the zone) is a good consideration during choppy markets. You want to keep losses as small as possible.

Follow our Crypto Market Analysis Closely

We’re insanely accurate when it comes to deciding which way the winds are blowing across the markets. If you read and listen to all of our content you stand a very good chance of being ahead of your competition.

The most important place to look is our market analysis section within your trading dashboard but you should also keep an eye out for new blogs and videos as we frequently share our ideas and other education.

For example, go to our blog page and you can read about our Bitcoin bear market bottom price prediction based on the venerable SuperTrend indicator.

We know this is an obvious tip, but you’d be surprised how often we find that people haven’t been paying enough attention!

Account for Closed Early Trades as Partial Losses

In our video covering how to be a long term profitable trader, Matthew mentions treating closed early trades as partial losses. By doing that you know it’s all just part of your longer term planning and it won’t rattle your cage as much.

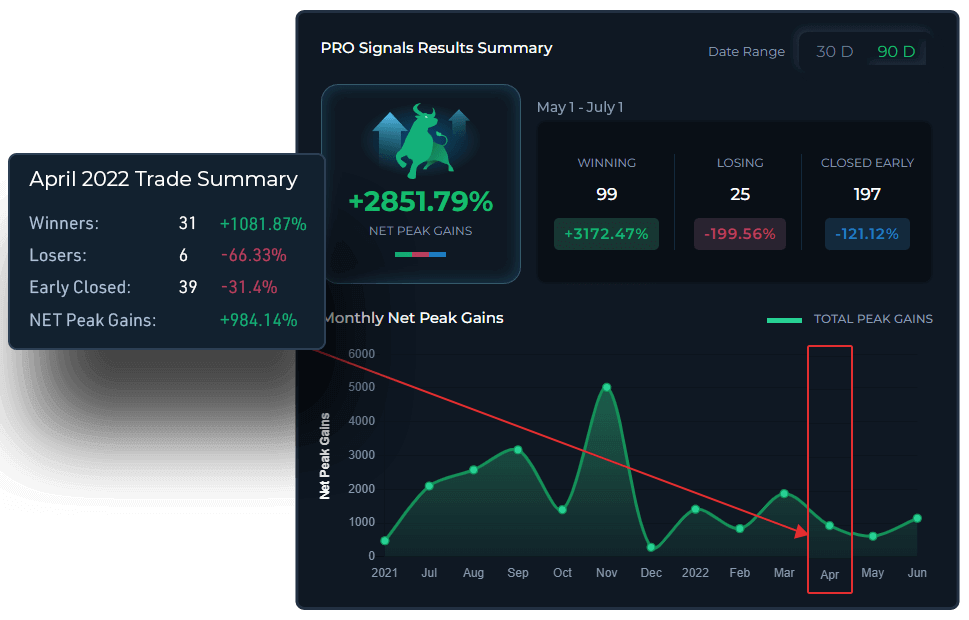

Let’s take a look at our signal results from April 2022 to put close early trades into perspective:

April was incredibly difficult to trade without help as the month was persistently choppy. This resulted in 39 closed early trades during that month.

But is that as bad as it sounds?

For April we had a total of 37 completed trades, with 31 of those hitting their 1st target.

If we add up the total gains per target and the number of winning signals this is what we get:

- 14 trades hit target 1 for a total avg. gains of 274%

- 10 trades hit target 2 for a total avg. gains of 357%

- 6 trades hit target 3 for a total avg. gains of 427%

- 1 trade hit target 4 for a total avg. gains of 22%

This amounts to over 1000% of total peak gains between the 31 winning signals!

Now take our trades that hit stop loss (6 trades) – the total loss for all losing trades during this month is -66%.

Now if we take all of our close early signals and count them as half a loss at around -5% (average stop loss is at 10% for April, often it’s lower), this means that the 39 closed early trades would total a loss of 195% (39 x 5).

If we combine the total loss for both stop loss and close early trades that’s around 261% loss.

If we subtract those losses from the gains that would still be a total of 736% ‘net’ gains up for grabs in April 2022.

It’s not unreasonable to count closed early as just a quarter of a loss if you follow the laddering + trade guardian tip above.

New Net Peak Gains Calculator!

We wanted to hammer home just how big the opportunities are even in choppy markets! Behold the ‘Net Peak Gains Calculator’. As you can see April 2022 was actually a whopping +984% with close early trades only costing around -30% (even nicer than our super cautious estimate of -195%).

So how do you set yourself up to grab a good chunk of those net gains? Read on…

Focus on Signals with a Good Risk:Reward at Target 1 and 2

Understanding Risk:Reward is fundamental to long term profitable trading, when in doubt it’s important to get back to basics and focus on trades that pay well when things work out.

Choppy markets often mean that Target 1 and 2 are about as good as it’s going to get (note: this is not true for certain signal strategies eg those playing newer listings can rocket 100’s%) so you need to factor this into your trade plan.

Depending on your long term plan you may be looking for at least 1:1.5 or 1:2 or anything at all really, as long as it makes sense for you.

When you open a signal up take a look at the loss% and the gains% at Target 1 to start with:

In this example we can see that we’re looking to make around 13% on a win at Target 1, and a loss of -7% if we get totally wiped out. That’s an R:R of 1:1.74 not too bad considering the expected win-rate.

Target 2 shows us a gain of 29%, if you want to place some sell orders at that level your R:R will jump up further.

In this imaginary scenario you would go ahead and cancel Target 3 and 4, stacking your sells at Target 1 and 2 only.

Using the Break-Even Stop-Loss in this situation would mean that if Target 1 is hit but then the price crashes, your coins waiting for Target 2 would sell for break-even.

Avoiding a winner becoming a loss or affecting the profits you collected from Target 1.

Go short if you really, truely, really, really understand how [really]

Let’s clear something up: Long vs Short trading

We prefer long trades when it comes to creating trading signals because they’re more reliable, easier to identify and give you more time to find and finalise your setup.

This works extremely well for our platform as we prefer to focus on the highest probability plays even if that means less of them.

Obviously if you’re an expert short trader, then Bearish markets are your most favorable hunting grounds. Slap on your vest, grab your bait and tackle, and go wrangle yourself some short-trading fish.

But short trading is just as complicated as long trading during choppy, sideways markets so it’s by no means a cure for all.

Read our guide to cryptocurrency market cycles so that you can identify the correct overall market trend before you begin to trade.

Conclusion - ‘Get Good’ or Just Relax and Enjoy the Ride!

Phew! That was a long one but we’re sure it’s been helpful.

Market cycles come and go and your choice is fairly simple in terms of how you handle it:

- Step out, enjoy the real world and ignore the markets when they are obviously choppy

- Level up your game and prepare for slightly more intensive trading

Either option is good as long as you’ve got a good long term plan and perspective.

Open a FREE ProfitFarmers account now!

If you want to trade like a Pro you can start for FREE and get access to life-changing features like:

- Copy-trade

- Auto-trade

- Trade guardian (auto-exit trades that deviate from the plan)

- Laddering mode

- Break-Even Stop-Loss

- RSI and Price Action Scanners

- Advanced trading terminal