Synopsis: Reading this article could be the best 15 minute time investment you’ll make all year. PAY ATTENTION. There’s a Bear Market triple threat knocking on the door! We combine our expert analysis with another reputable fund manager’s views to show that Bitcoin will be under serious pressure for the next few weeks, but that means a BIG BUY opportunity is around the corner. We discuss our key price predictions and the reasons behind it below.

This is bit of a long one, don’t worry if there are parts that are too technical for you, it’s the overall message that you need to absorb.

We recommend you listen AND read by playing the video and then following the text below so you don’t miss anything important. We’ve left charts and guides down below that could help you catch the market cycle bottom!

Don’t forget to sign up for a FREE account if you want to get access to more market analysis from our experts as well as trading tools, education and more!

Welcome to ProfitFarmers SPOTLIGHT Edition

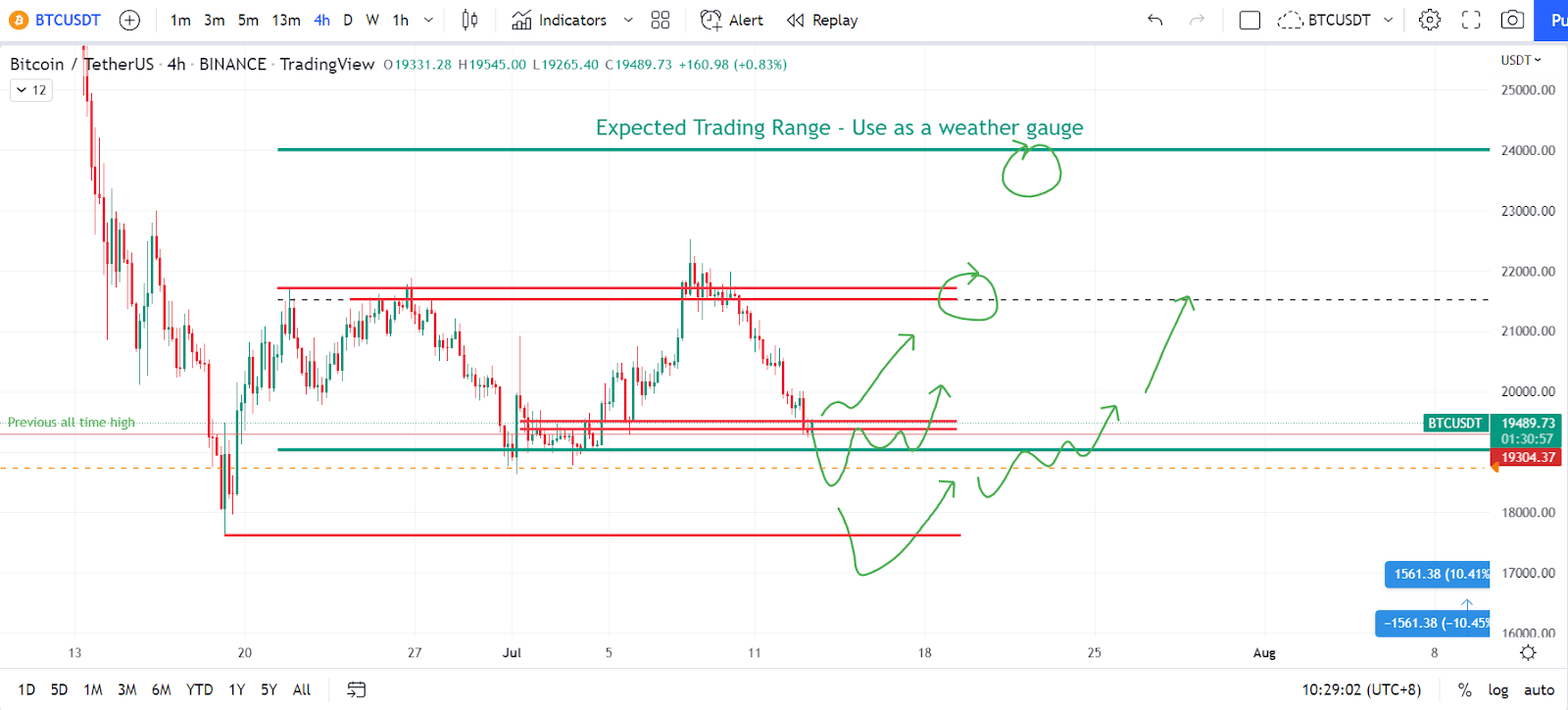

While everyone is interested in Bitcoin’s next move, let’s discuss the top catalysts for price action in the next few weeks. We have some important events lined up that may impact Bitcoin prices. Technically speaking, Bitcoin has found a floor around the $18,500 area and a top around the $23,000 zone.

The key question, however, is which side will Bitcoin breakout next. We analyze both breakout and breakdown scenarios.

While many pundits are predicting a new all-time high by next year, we expect a lot of sideways and consolidation before any breakout above the all-time high. We prefer to focus on immediate areas of interest.

But before that, let’s discuss the top catalysts that are responsible for driving short-term bitcoin price action.

The Best Crypto Trading Community - Get All This Free

- 78% win-rate Trading signals*

- Copy-Trading

- Trade Guardian

- Laddering (you don't have to sit at your computer all day to protect your money)

- Market Intelligence

- Advanced Trading Terminal (With 20+ Order Types)

All 100% free – no time limit. You’ve got nothing to lose.

It’s like you’re getting a crypto supercomputer with decades of experience to sit over your shoulder and help you trade – all for free.

Sign up for ProfitFarmers now, and you’ll access life changing trading powers, 100% FREE, in just a few minutes.

*NO CREDIT CARD REQUIRED

Catalyst Number 1 - The DXY

The dollar index, DXY, is currently on fire, and almost every major currency is losing value against the dollar. Bitcoin is not immune because it is primarily priced in USD. This is currently one of the most important catalysts.

DXY will face some resistance within a 2-3% move from current levels. However, if the DXY price breaks above the resistance level, almost all major global currencies will experience a massive crash.

While the DXY Bitcoin inverse correlation has not always been this strong, the weekly correlation coefficient between BTC and USD fell to 0.77 below zero in the week ending July 3, the lowest in seventeen months.

This is primarily due to these markets’ year-to-date performances amid recessionary fears, which have been fueled by the Federal Reserve’s benchmark rate hikes to combat rising inflation.

In 2022, Bitcoin, for example, has lost more than 60% of its value. On the other hand, the USD has done well, as measured by the U.S. dollar index (DXY), which compares the strength of the USD against a basket of top foreign currencies.

To date in July 2022, it has gained 14%. The dollar index may continue to rise as long as other global macroeconomic actors do not follow the Federal Reserve’s lead.

So, when will Bitcoin be decoupled from the rest of the world’s currency? Theoretically, Bitcoin shouldn’t be in this position in the first place at all. For those looking to de-risk right now, USD is the best option. USD has emerged as the safe-haven asset of choice for investors.

So far, investors haven’t embraced Bitcoin as the best inflation hedge. Even while the case can be made, there aren’t many serious takers, and USD still rules.

This may change in future but Bitcoin has not lived up to the hype, despite the best efforts of Twitter’s pundits to persuade the public otherwise.

Where do we go from here?

At ProfitFarmers, we believe strongly in Bitcoin and its ability to disrupt major currencies like the USD as a potential inflation hedge. On the other hand, we’re also realistic about the timing of such an event.

We anticipate Bitcoin will be under pressure as long as the deleveraging festival continues. In terms of Bitcoin’s recovery, this is one of the most significant risks.

Catalyst Number 2 - The 3AC Meltdown

When it comes to Bitcoin, the ongoing bankruptcy procedures against Three Arrows Capital (3AC) could cause a delay if recent reports regarding the owner’s absence are true.

We’re presenting the opinions of a respected asset manager on the impending bankruptcy of 3AC and how the disappearance of the owners may postpone Bitcoin’s possible move towards the $27,000–$30,000 zone. Here are some thoughts from a reputed asset manager on this entire 3AC situation.

Let’s dissect this weekend’s news that 3AC wasn’t “cooperating with liquidators. ” It likely changes the timeline and severity of any forced selling. If 3AC is indeed entirely uncooperative, this could mean the following:

- Some liquid tokens they hold in EOA wallets can't be seized.

- Any tokens in custody or exchanges will be seized and liquidated.

- GBTC allocations will be seized.

- Tokens in vesting contracts could be seized.

- Their "class share" funds, including DeFiance, will be in a fight for their lives to try and not be liquidated.

Depending on the existence of any agreements, projects that let them “manage” their treasury may have no path to be recognized in the liquidation process. A lot of this is bad.

The liquidation of class share funds, the loss of treasuries, and forced selling (likely over the counter – OTC) of any vesting positions will really hurt the industry, especially during a bear market. It could lead to a lot of young projects folding.

As we know, 3AC was a major owner of GBTC, and it can easily be seized. As you know, GBTC usually sits at a discount to the Bitcoin price due to fees, liquidity, conversion risk, etc. But, the big question is GBTC.

The first few questions that will be related to specific regulations around bankruptcy in their jurisdictions are: Will debtors be paid with in-kind transfers of stock? Or, will they have to liquidate first?

The hope is number 1, which means that the loss will be absorbed by creditors on their books—which could make sense for them given the steep discount on GBTC.

If there is a future conversion point to an ETF, the price parity could mean great upside. But, of those who owned debt, we know that at least a few of the largest positions were owned by people who were using clients’ funds.

Entities that are undergoing their own bankruptcy proceedings. So it seems unlikely that these groups will want to hold in-kind.

When we look at the risk of the GBTC selling, we can’t really measure the size of the hole, as we have no idea how many times these assets could have been promised as collateral.

However, we can understand how they will liquidate.

Longs pay shorts if positive, shorts pay longs if negative and the rate moves based on the directional time-weighted delta between the price of the spot and the price of the perps.

But here’s the really important part: Historically, being short-paid because crypto has had high growth and has more market involvement and FOMO in upswings, shorts have always been paid more than longs.

Now, normally this doesn’t matter, because the change in nominal offsets the funding rate. But, it does mean if you have a delta neutral position (sell short, buy spot), you get paid. With the GBTC product at a -30% discount, it represents an opportunity for market makers to:

- Short 1 Bitcoin per point.

- Buy 1 Bitcoin's worth of GBTC at a discount.

- Repeat this process until that gap is closed.

Now, things like this don’t play out perfectly, but let’s imagine that it drags down the perp price by minus 15% and brings up the GBTC price by plus 15% to close the gap.

We might think “great, contagion is over” but we’ve still got a large, sophisticated Market Maker with a large covered short. It might be in their best interest to scoop up some spots here or roll off some of their shorts here, but remember, being short pays.

So if the Market Maker is sophisticated enough, there is a huge incentive for them to heavily price the market at this level and collect funding. We’ll know the contagion risk is over from that particular risk when we see some closing in the GBTC price gap.

Now, 3AC is not the entire GBTC position, and the GBTC position should have a discount based on a number of factors. But, in the last filing we have circa 2021, 3AC owned 39 million shares of GBTC (22%) and at that time, BlockFi also owned a large portion.

If that number has held, and they continued to buy through offering their ‘arbitrage’ product that we heard of in 2022, they could own a major portion of the outstanding GBTC, which sophisticated market makers will know skews the liquidation.

So, rather than expecting the spot to fall by 15% and GBTC to rise by 15%, the large sell will likely cause the spot to fall even further to meet GBTC because very few buyers have the scale or risk appetite to step up.

That likely means your institutional holders and mutual fund holders are going to take a further hit on this (especially if BlockFi still owns their 3% position and tries to front-run this selling due to their own financial challenges).

So ARK is likely to be the biggest public fund to take a hit here, along with some Morgan Stanley funds. While it is a small percentage, it will have the effect of making mainstream funds more cautious about anything crypto in the future.

In terms of trade impact, the losses of pension funds on Celsius, BlockFi, etc are likely to have a higher impact. However, it does imply that large market makers with cash on hand and a risk appetite can likely squeeze retail prices much further.

It’s also just one more arrow in the quiver of regulators looking for reasons to not approve further crypto products.

So the hope is that enough people owed funds by 3AC will take on the in-kind transfers of GBTC for potential upside and that local liquidation allows it. Let’s wait and see.

Well, those were the thoughts of a reputed asset manager about how the disappearance and non-cooperation of 3AC owners would impact Bitcoin in the short term.

Catalyst Number 3 - Mount Gox

Hacked Exchange Mount Gox has released a recovery plan for its victims. 137,000 BTC may soon hit the market as Mount Gox is set to release funds to creditors that have been locked up for 7 years.

How may this affect the price of Bitcoin and will it cause a further leg down?

Well, there is a lot of FUD going on about these Bitcoins hitting the markets. While the true impact cannot be predicted or measured, we expect some psychological pressure on market participants on account of this catalyst.

There is an argument that most creditors will hold their bitcoin and won’t sell as prices are down 70% from the recent high, but at the same time, we need to understand that these people bought bitcoin when it was trading below $1000.

We can’t say conclusively if this will affect Bitcoin prices negatively but the sentiment will remain heavy until the Bitcoins are released in the next few weeks. So between DXY, 3AC Bankruptcy & Mount Gox Bitcoin release schedule, we have enough material to conclude Bitcoin price will be suppressed in the short term.

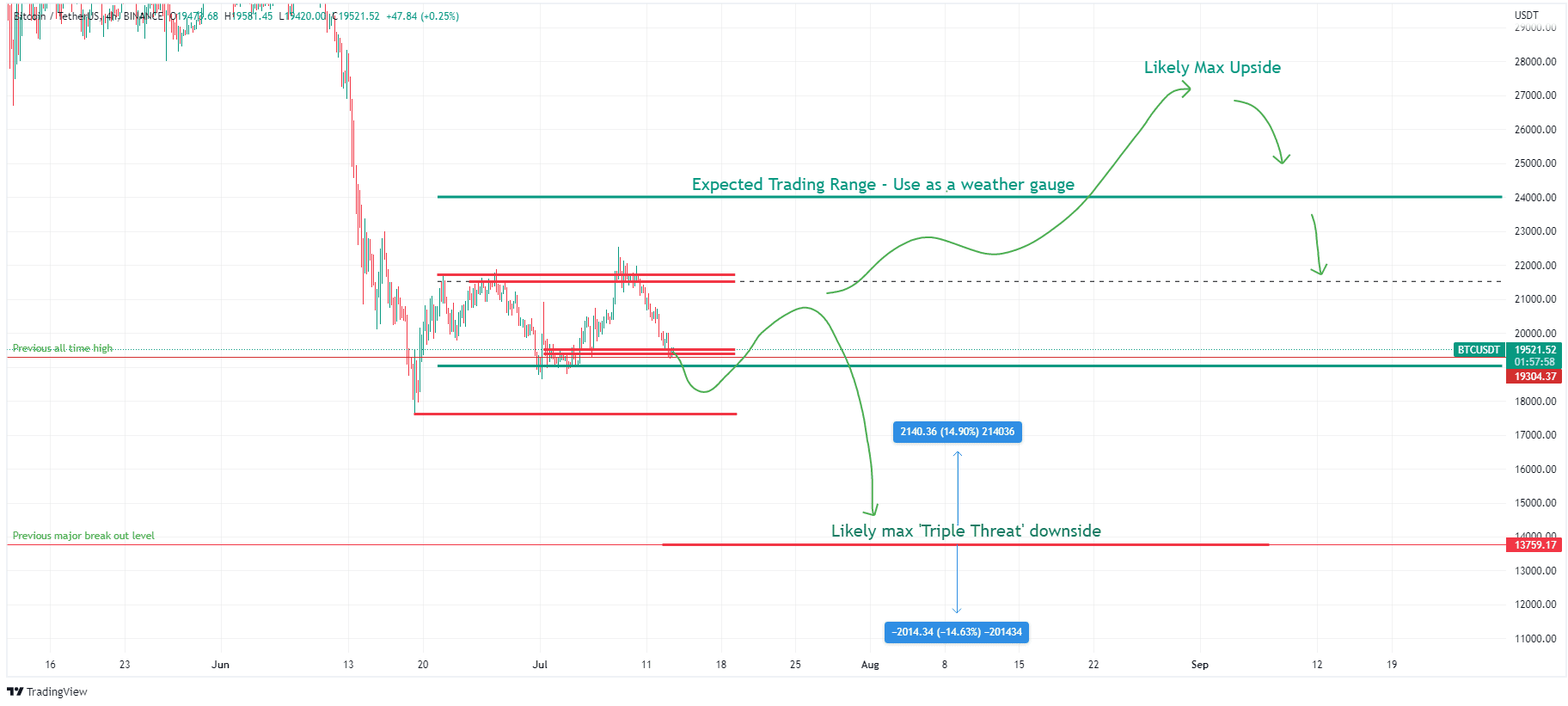

In terms of lower levels for Bitcoin, the $18,500 area is strong support. If that area breaks down, the next strong support is the $13,900 area which is a Monthly HIGH for the previous bull market and key breakout level. We will be bidding aggressively in that area if Bitcoin chooses to dump there.

Again at Profitfarmers, we do not like to speculate well in advance about price levels, but if we have to choose one level today, that is $13,900 +/-15%

So is it all doom and gloom?

Well Nope. This can all very well be a big trap to scare people, forcing them to exit their long term positions at loss. If BTC breaks above the recent high, we can still go to $27,000 first before breaking below $18,500

Also remember selective Alt coins have started pumping already and we will get ideal trading conditions if Bitcoin goes sideways. Just stay away from long term positions until this Bear Market Triple Threat is over.

How to Trade Bitcoin During the DXY Bulldozer - Step by Step

We may have an opportunity to scalp some bounces soon depending on how the DXY behaves.

DXY is approaching resistance around 112. If this resistance holds and the DXY pulls back, global currencies including BITCOIN should get some relief.

At the time of writing, Bitcoin is currently sitting in the lower part of it’s recent trading range around $19,000 and is in a prime position for another trip LONG.

Ideally we get some obvious market maker signals that it’s time for that trip back up. Here’s what to do:

- Watch the DXY as it approaches the 112-115 area

- Looks for signs of resistance holding (shooting stars, swing failure patterns, etc)

- Check the BTCUSDT chart once DXY has reached the resistance zone and stopping

- Review key BTC liquidity levels and look for stop hunt and reversal price action

- Enter Long once BTC reclaims the locally broken key level

The lows to watch for are around $18,700-$19,000 or even $17,600 if something wacky happens.

Key levels are shown as Red and Green lines. Remember, price action can do ANYTHING, but what we are hunting for is a clear trigger. A reason to get long and take a ride, we’re just showing typical examples here. Look for anything similar.

Ideal price action is drawn onto the chart below. Again, wait to see Bitcoin location VS the DXY as the DXY approaches the resistance zone mentioned. Then simply take your trade based on the key levels shown.

Sign up for a free account and you’ll receive newsletter and YouTube updates on the triple threat and all the opportunities that come with it.

ProfitFarmers is Now 100% Free - Free Market Analysis, Crypto Signals, Copy-Trade, Auto-Trade, & Pro Automations

ProfitFarmers, an all-in-one crypto trading platform that lets anyone trade like a pro, is now 100% free to use.

You don’t need years of experience, a huge bankroll, or endless free time to master trading anymore – just listen to our analysis, copy our signals, choose your automations, and let our platform handle the hard work.

You can get started immediately for $0.

Your free account includes:

- Expert analysis just like this article!

- 78% win-rate completed signals

- Auto-trading

- Automatic laddered entry

- Trade Guardian (automatically exit “close early” trades)

- Trading education

- Market research tools like our Price Action Scanner

Our win rate in 2021 was a staggering 78% on completed signals. That’s insane if you think about it. One of our signals generated 1500+% peak gains – just one signal.

Trustworthy, no nonsense trading tools and analysis at your fingertips. You don’t need to be a pro – in fact, many of our members got started with little to no experience and learned from us for free.