Hey there ProfitFarmer!

We wanted to explain how we calculate the overall signal results when we conduct our usual monthly and yearly breakdowns.

But before that let’s talk about how these breakdowns are useful to you.

Theorycraft to become a better trader

By looking at the overall performance of all signals across a period of time it can give insights into how our underlying strategies are performing in recent market conditions. Patterns may emerge that you can investigate to help increase your personal trading gains.

Start with these steps:

- Analyze the wider market and decide if we are down-trending, up-trending or in a sideways range (chop city). If the market dynamic has changed since our last breakdown be cautious making too many future predictions based on historical data.

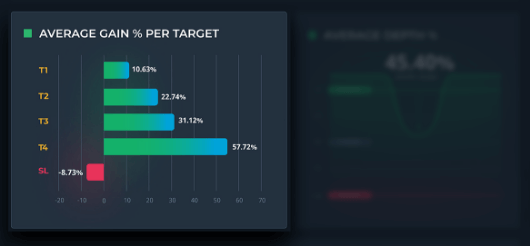

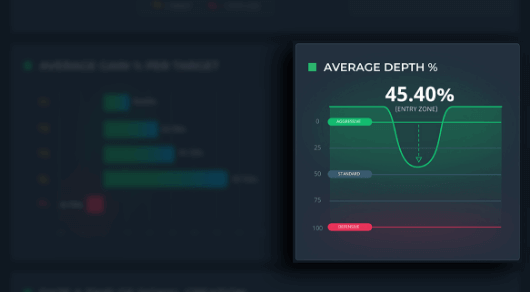

- Investigate the recent signal performance, in particular think about the % of trades making it target 1/2/3/4 as well as the average gains made at each level and the average entry depth.

- Consider the optimal trade setup to make based on what you can see and write down your default plan.

- When signals arrive keep your new default plan in mind as you finalize each new trade plan.

Scenario: Shoot for the moon

The market has maintained a clear uptrend and we are in buy the dips mode. Recent results show a good % of signals making it to Target 3 and 4 (which typically signifies ongoing breakout price action). The average entry depth is only 30% which suggests a lot of bullish activity is ongoing. Your main goal is to milk this uptrend dry. Fire everything you’ve got whilst the wind is blowing in your preferred direction.

Your default plan:

- Aggressive laddering entry (learn more) to ensure you get into each trade without being left behind by the rest of the bulls

- Take profits will be weighted in favor of reaching T3 with T4 being a bonus

- Stop loss can be moved up tighter than standard as the market should move up swiftly in order for us to be on track with our overall analysis. If you are wrong, you want to get out fast and reassess.

- We are uptrending, now is the time to strike. Risk management (learn more) can be adjusted to allow larger trade sizes than in choppy markets.

- You take breakeven stop-loss mode 2 (learn more) to ensure that you aren’t knocked out of your moonshot trade early.

Scenario: Sniping the chop

The market uptrend is starting to fall apart. Multiple coins are either down-trending or ranging, trying to find a bottom. Price action is nasty and erratic but you don’t have the patience to sit and wait it out. You think there are still some solid plays to make.

Recent results show a lot of ‘closed early’ trades and most signals don’t make it past targets 1 and 2. The average entry depth is around 50% suggesting the market has cooled off. Your main aim is to keep your trading account out of harm’s way and make incremental gains where possible.

- Standard laddering entry to keep a balanced approach in line with the market.|

- Take profits will be weighted in favor of Target 1 and Target 2 only. 70-80% of your trade will sell out on T1 to ensure you always take home a decent prize when you make a kill.

- Stop loss will remain at standard unless the charts call for an adjustment.

- Standard Risk management applies, it may even be worth taking a reduced position size for signals you are not confident in.

- You take break-even stop-loss mode 1 to ensure that you protect your Target 1 profits.

- You enable Trade Guardian (learn more) to ensure that close early trades aren’t too much of a hassle.

- You are always ready to sit on your hands and make no trade at all < this is what makes you a king in the long term.

By doing some digging it is possible to theorize all sorts of trade ideas that could either increase your profits or minimize your losses.

How to read the statistics breakdown

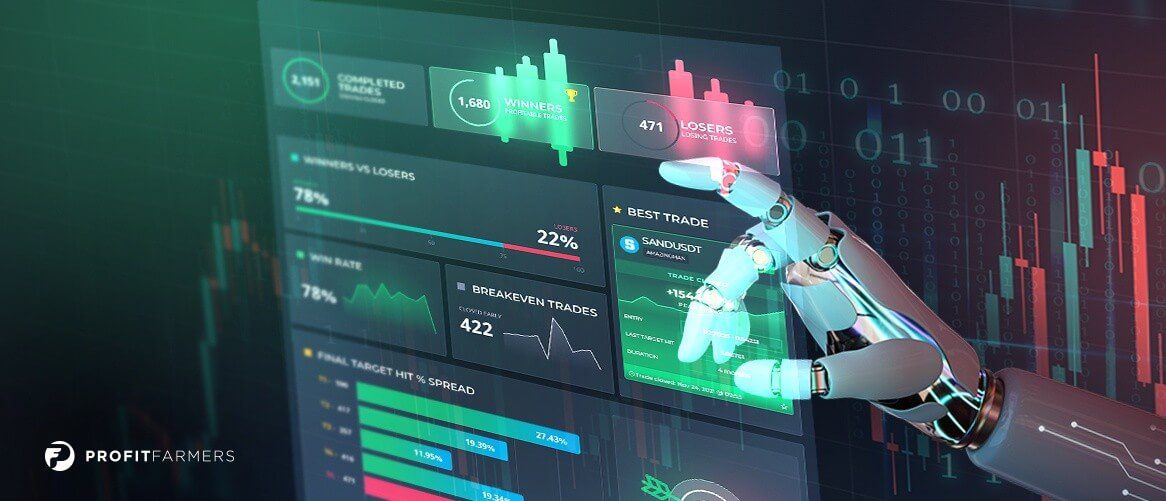

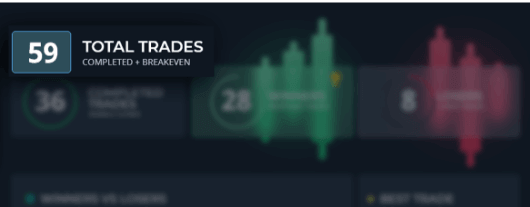

1. Total trades

This is the total number of signals bundled together including completed trades and closed early trades, learn more about those below

2. Completed signals/trades

This is the total number of signals that reached a natural end, either hitting at least 1 target or the default stop loss. These trades are closed and no longer ongoing.

3. Winners

Number of completed signals that successfully reached at least 1 target.

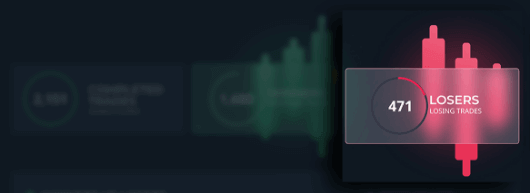

4. Losers

Number of completed signals that failed to hit any target and were stopped out.

5. Closed Early

Number of signals that failed to complete and were suggested to close early before stop loss or any target hit.

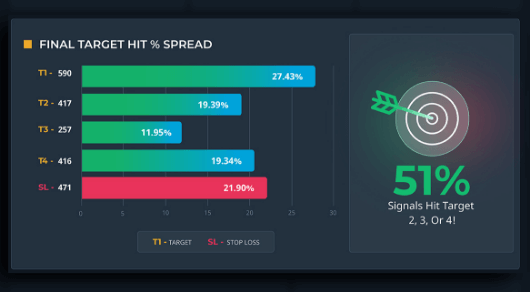

6. Final Target Hit % Spread

Count of how many signals reach each relevant target. % is of the total completed trades.

7. Average Peak Gains % per Target

% gain from best entry price recorded in the entry zone to the specific target mentioned.

8. Average Depth %

The average depth that the price came down to as a % of the suggested entry zone. e.g 50% would mean the price typically came down to the middle of our suggested buy range.

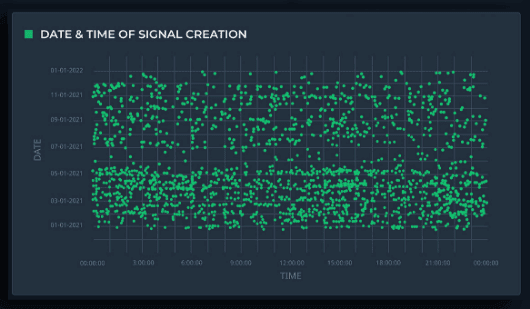

9. Date and time of Signal Creation

Each completed trade’s date and time (UTC timezone) is marked by a dot on the chart so you can see when the signals typically arrive. Typically you’ll see that they arrive at all hours of the day all throughout the month.

10. Top 10 trades

Highest gainers of the trades that came to a close during the date range.

Closed Early Trades - A Thorn in Every Trader’s Side

A scratch, a draw, a break-even, a partial loss or win, an early exit.

No matter what you call it, nobody likes it. But closing down a trade early is a natural and necessary part of profitable long term trading.

The signal algorithms and also our human trading experts may at times suggest it’s time to pull the plug on a trade and get out. At that time we issue a ‘close early’ notification.

Why do we throw these away when looking at winners vs losers?

Typically these trades are not a win or a loss, but are around break-even. Traders taking defensive entries will probably see a small profit. Traders taking an aggressive entry could see a small loss. On average we’ve seen the range to be between -3% and + 3% but there will always be some outliers.

On top of that, focusing on completed trades allows you to spot the patterns we were talking about further up the page. Separating closed early trades also allows you to identify which strategies to avoid if you don’t like the chop (see below).

You can handle close early trades one of 2 ways

- Leave Trade Guardian on let the system automatically handle this for you

- Manually intervene and decide if you agree or disagree with our views

Visit the Trade Guardian feature page for an understanding of the pros and cons.

How you can minimize the impact of closed early trades

- Don’t trade during very choppy markets – Patience pays off

- Avoid signals on strategies with larger amounts of closed early results (e.g some CM strategies are often closing early in choppy situations)

- Don’t make overly aggressive entries during chop so that you rarely take a meaningful loss

The Net Gains Calculator - Visualise how Signals are Performing (Including Closed Early)

Find out exactly how winners, losers and closed early trades are stacking up against each other at any time by logging into your dashboard. This tool summarises the total trading opportunity so you can see exactly how big the ‘profit pie’ is at anytime. You’ll quickly realise that closed early trades aren’t really an issue! We call the calculation the ‘Net Peak Gains’ as its winners minus all the full and partial losses.

Accuracy and Transparency

At ProfitFarmers we know that transparency is a MUST HAVE when it comes to any business in the wild Cryptocurrency space. It’s no different for our results where we do our very best to ensure a timely and accurate breakdown, but there is always a small chance that we’ve got something wrong.

We rely on various 3rd party connections (such as Binance.com) in order to track every single signal we create at all times which can mean that we risk missing some details without meaning to if their services have problems. Software and servers can also suffer from outages or bugs which could also lead to inaccurate or missing information.

Good news! We have automated services that are already in place to handle these types of exceptions described above but there is simply no way we can guarantee we are always 100% accurate at any given time. We really do want to be though, we promise!